Many workers face financial emergencies at one point or another in their daily lives; it is not absurd. There are times when unplanned needs arise. You may need to settle unplanned hospital bills, emergency car repairs, and maintenance of some household appliances. Sometimes, you have no option but to seek loan apps for payday loans. After all, you should be able to repay the borrowed money when you are paid your salary at the end of the month. And this is how employees fall into the payday debt cycle.

What is a Payday Loan?

A payday loan is a short-term loan offered by lenders based on the borrower’s income. They are designed to help borrowers tend to their immediate expenses. Payday loans usually attract a high interest to be paid at the reception of the monthly salaries. The high interest attached to payday loans usually makes it uneasy for the loan takers to pay back on time. Usually, they are forced to take another loan to make up for their expenses, and the interest keeps accumulating.

Generally, payday loans are considered a bad option due to the high-interest rates that comes with them. Finding a better alternative is key. What other alternative is out there?

Introducing Earnipay’s On-Demand Pay

Let’s assume you are paid a ₦300,000 in a 30-day month. Your daily pay is then ₦10,000. That is, in five days, you already made ₦50,000. What if I tell you you can access your earned salary every day before the 30th day of the month? Yes, this is possible with the Earnipay on-demand pay solution.

With Earnipay, you can say yes to your financial freedom by introducing the On-demand Pay product to your employer. You can access up to 50% of your earnings daily at 5 pm when your employer gets you onboard. This way, you can say goodbye to payday loans, better match your income with your expenses, and build great financial habits.

What do you stand to gain as an employee using the On-demand Pay product?

As an employee, you are less likely to fall victim to predatory payday lenders. The On-demand pay product is one sure way to avoid this. Some other benefits an employee stands to enjoy from using Earnipay’s On-demand Pay product are:

- It provides a financial safety net to cover expenses and urgent payments.

- You can take advantage of investment opportunities with the flexible payment system Earnipay offers.

- You can avoid unnecessary borrowing from friends and family.

- You can access earned salary on the go via web app, mobile app (Playstore or App Store), or USSD – *347*729#.

- It encourages and promotes good spending and saving habits.

How does Earnipay’s On-demand Pay Solution work?

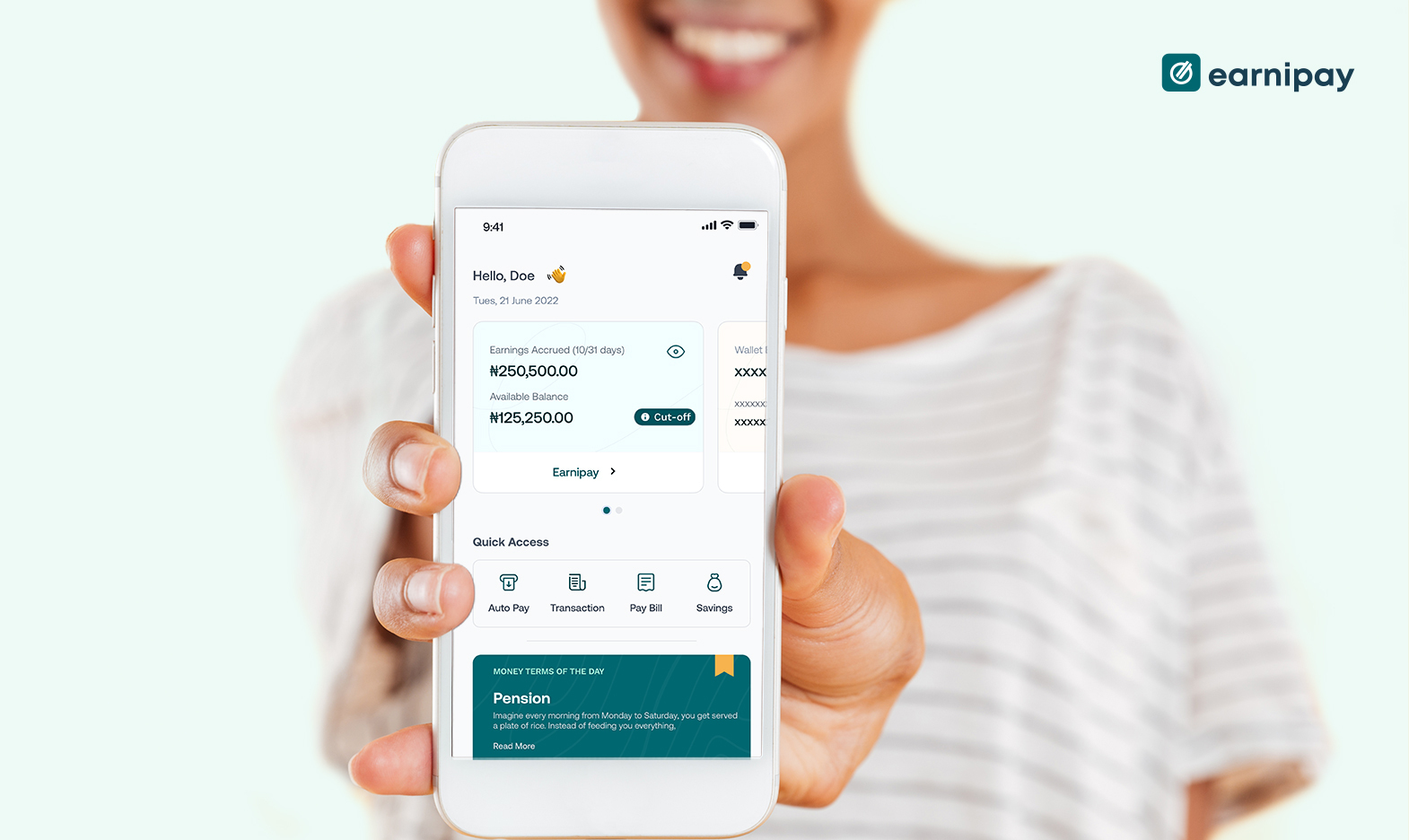

Once your company has been onboarded on Earnipay, You will receive an invite to download the app and set up your account. Once your account is set up successfully, you can sign in to the Earnipay App.

On the Home screen, you will see your dashboard showing the earnings you have accrued and how much you can withdraw. Click on “on-demand pay”, insert the amount you would like to withdraw and select the destination account. You can withdraw to your Earnipay wallet or your salary account, select the purpose of your withdrawal, review the information, insert your pin, and get paid!

Your money will be credited to your account in less than one minute! It’s that easy.

You can also access on-demand pay via the web app at www.earnipay.com or the USSD code *347*729#.

How do I get started?

To use Earnipay’s On-demand Pay product, your company needs to be onboarded on Earnipay. You can drive this by referring your employer to register on Earnipay. Simply visit www.earnipay.com to refer your employer.

Takeaway

Now, you know what it takes to say goodbye to payday loans and enjoy all the benefits that come with getting early access to your earned salary on Earnipay.

Join hundreds of employees enjoying this amazing workplace benefit today.

Leave a Comment