Whether you are an employee, business owner, or HR professional, understanding how payroll processing works will help you avoid errors that could wreck your financial stability and that of your organization. Payroll processing is a core department of every business that helps to strengthen employee retention and stop the company from running at a loss.

Imagine issuing untimely payments to your employees at a time such as this in Nigeria, when the inflation rate has accelerated to 21.82% based on the National Bureau of Statistics. Guess what the resultant outcome will be in your organization.

- Your employees will lose the trust they have in your company.

- Their morale will decrease, which will lead to laxity at the workplace.

- Plus, your employees will leave a particular work due to untimely payment to a much better organization that understands the essential step-by-step guide to payroll processing for beginners.

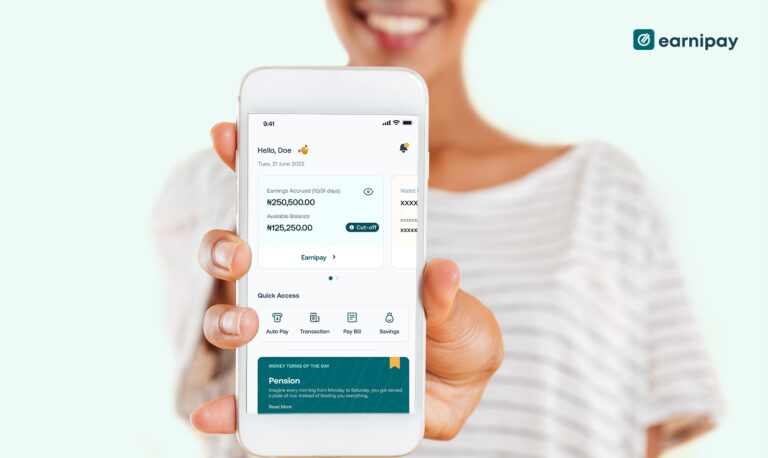

No one wishes these kinds of incidents to happen to an employee or a business owner. This was why Earnipay was established. One of the solutions we provide is simplifying how you pay people, whether as a freelancer or a team of 100 and above. But how would you understand my point when you are yet to fully understand what payroll processing is and how to use payroll processing? Not to worry, by the end of this article, you will know what payroll processing is and how it works as a beginner.

Introduction to Payroll Processing

The joy that follows when receiving a paycheck at the end of every 21 business days is usually unparalleled. However, before a deposit is sent to your local bank at the end of 19-21 business days, there is usually a rigorous process of calculating the employees’ payments based on the number of hours they have worked and deductions for taxes and company benefits. This process of managing employees’ payments is called Payroll processing.

Processing payrolls is one of the most overwhelming tasks in every business because it requires diligence and core competence in managing employees’ payments to avoid errors and ruining the company’s reputation. This is why a few companies outsource this role to a team of professionals who are skilled in accounting and payroll management to manage their employees’ payments.

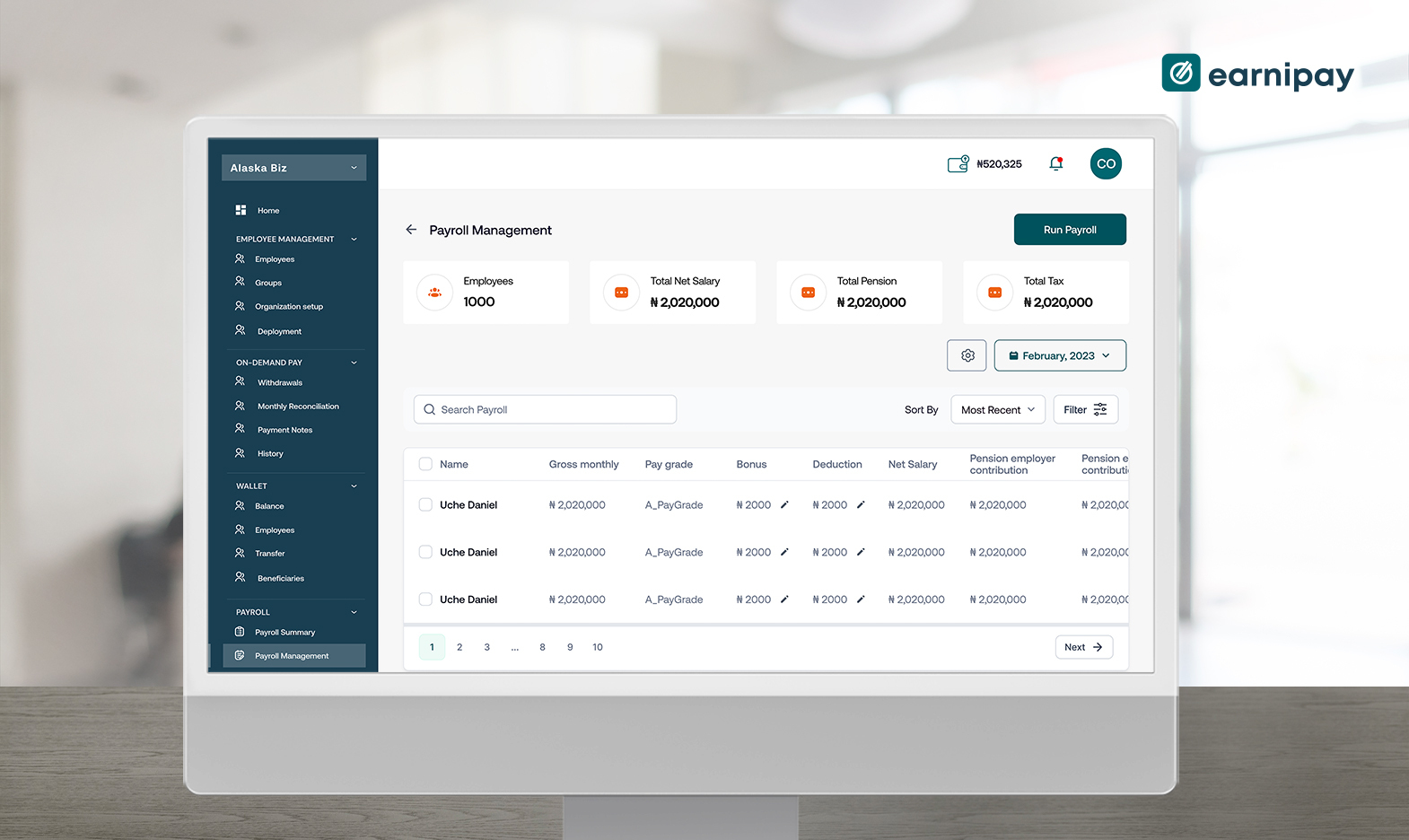

Nonetheless, things have changed, and because we are in the center of a digital economy, you can outsource these roles to third-party tech startups like Earnipay that are willing to help cater to your huge payroll processing needs despite the size of your business. With our payroll processing product, your business can efficiently manage the payroll of all your employees.

Earnipay’s Payroll Processing & Financing Solution

Our product offers a range of features to streamline payroll processing and financing for businesses. These include:

- Automated payroll calculations based on employee days worked and pay rates

- Integration with tax and benefits systems to accurately calculate deductions

- Options for issuing paychecks or direct deposits to employees

- Access to financing options such as credit to support your payroll.

- Access to on-demand pay which allows your employees access their salaries whenever they need it.

- Advanced security measures to protect sensitive financial information

How do I use Earnipay’s Payroll Processing Product?

Using payroll processing is pretty simple. We built payroll processing to be user-friendly and easy to navigate. Additionally, we offer a chain of training and support materials to help you have a satisfying user experience while trying to manage your payroll. To use payroll processing like Earnipay, you will be required to follow the following steps:

- Log into https://earnipay.com/ and click on the sign-up button.

- Enter your details and business details and create an account.

- Set up your payroll options. It includes selecting your payroll frequency and setting up automatic payments that best meet your business needs.

- Begin processing payroll on Earnipay.

How secure is Earnipay’s Payroll Management?

Yes, security is a top priority for us. Our product utilizes advanced security measures to protect sensitive financial information and ensure user data confidentiality.

How Important is Payroll Optimization?

Payroll processing is so important to every business that its relevance can not be ignored. Some of the importance of payroll processing are:

- It preserves the company’s reputation

Aside from being able to fulfill the obligation of meeting employees’ needs as regards timely payment. The company’s reputation will be void of fraud or unpleasant publicity for not adhering to tax policies. No one wants to be associated with a company with a bad name, making payroll processing service providers like Earnipay a viable option for businesses.

- It boosts the morale of the employees

Efficient payroll processing motivates employees to carry out their day-to-day tasks because they are certain of receiving their paychecks when due, catering to their needs, and taking part in positive futuristic investments.

- It protects the confidentiality of employees’ payroll data

We guarantee the best security of your employee data.

Now that you’ve got a basic overview of what payroll processing is and how to use our payroll processing product, you will be causing major chaos in your business if you choose to stick with the manual method of payroll processing; when you can get access to our all in one payroll processing solution for free. To get started, visit https://earnipay.com/

Leave a Comment