One of the goals of every working professional is to achieve wealth creation- a financial stage that enables one to accumulate cash flow greater than H/her current lifestyle.

As feasible as these goals seem, it is not a straightforward journey. It involves implementing varying wealth-creation strategies that will keep you out of financial bankruptcy for life. As you read further, you’ll understand the top-notch wealth-creation strategies I have put together for working professionals who desire to live in abundance.

7 Wealth Creation Strategies for the working professional

- Adopt abundance mindset: As aforementioned, the journey of wealth creation is not a straightforward path. By this, I mean it involves implementing several strategies like adopting an abundance mindset. An abundance mindset is having a belief that money is sufficient for everyone. When your mind is open to money, opportunities gravitate toward you. As a working professional, your mindset is crucial to creating wealth. If at this point, you are still struggling with a scarcity mindset, then it will take a while to get close to attaining financial freedom. Below are a couple of ways to move from a scarcity mindset to an abundance mindset:

- Surround yourself with working professionals that have an abundance mindset

- Condition your mind to always see possibilities and opportunities at all times.

- Set financial goals: Financial goals are deliberate targets individual sets to achieve a financial milestone. Financial goals vary for every working professional. Nonetheless, these goals range from having a retirement plan repaying loans and lots more. Setting financial goals as a working professional will do the following:

- It will enable you to make informed financial decisions on spending, saving, and investing.

- Enable you to imbibe patience and discipline while spending and saving.

- Lastly, it gives you a sense of fulfilment for achieving a financial milestone.

Types of financial goals

Short-term financial goals: These are financial goals that ought to be attained in less than 3 years. Examples of short-term financial goals include saving for car repair, paying off outstanding debts, or increasing retirement funds. In general, short-term financial goals aim at improving financial stability shortly.

Mid- term financial goals: Mid-term financial goals are financial targets set between 3 to 7 years. They could be to start a business, buy or build a house or even invest in stocks. This particular financial goal requires a lot of planning and discipline compared to short-term financial goals.

Long-term financial goals: They require over 10 years to accomplish. Having diverse streams of income will enable you to achieve this financial goal.

3. Increase your chances of earning more: Increasing your chances of earning as a working professional involves investing in yourself. With the availability of technology, obtaining a second degree or learning a new skill could be achieved from the confinement of your home. You do not stress over juggling different locations to increase your market value.

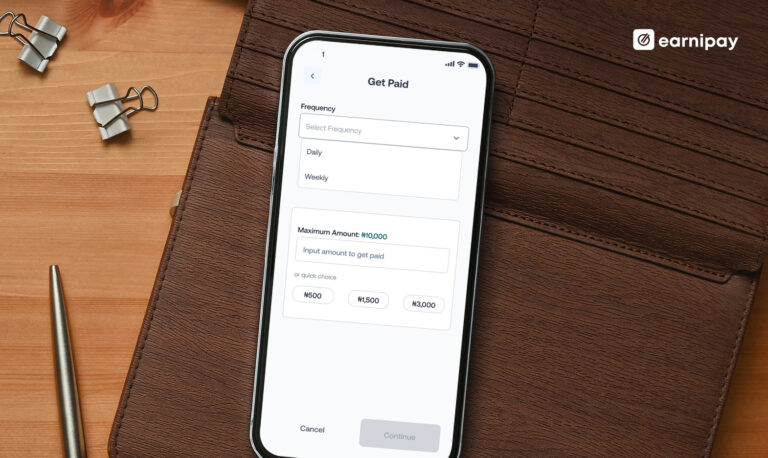

4. Saving habits: It means consciously keeping some of your earned income aside for rainy days. One of the proficient benefits of saving habits is that it allows you to have a safety net for emergencies. Some saving habits include creating and sticking to your budget, automating your savings, and tracking your expenses.

5. Invest wisely: Saving is not much of a realistic strategy for wealth creation for a working professional. Instead, investing is a more realistic strategy because it enables you to grow your money. Most important is diversifying across many investment vehicles such as stocks, bonds, mutual funds, and exchange-traded funds. Investing involves due diligence and researching potential investments before committing your money. It also includes analysing financial statements, evaluating market trends, and consulting financial professionals to help you make informed financial decisions.

6. Be frugal: Being frugal does not equate to being cheap. Instead, it is being intentional about what you do with your money when spending. Spending less is one wealth-creation strategy that can help working professionals pay off debt and attain financial freedom. Frugal habits include shopping quality used items, consuming less, utilising discounts, and many more. Adopting a frugal lifestyle can help individuals build wealth, pay off debt, and achieve financial independence. It can also help reduce stress and increase overall happiness by allowing individuals to focus on the things that truly matter to them.

7.Build multiple income streams: Due to the volatility of our current economy, you do not want to be taken by surprise when unexpected events occur, such as being laid off at work. Hence, a reason to consider having multiple income streams to enable you to create wealth. Multiple income streams include coaching, freelancing, content, starting a business, etc.In general, wealth creation strategies for the working professional involve developing a long-term financial plan and intentionally maximising income, reducing expenses, and investing wisely. Practising these wealth-creation strategies will help you achieve some of your financial goals as a working professional.

Leave a Comment