The first time you heard the word “Earnipay,” what came to mind? Okay, we are not talking about our product now, let’s talk about the spelling.

While the name is unique and easy to remember, there are some common misconceptions associated with its spelling, and we will be walking you through them.

For example, if you are a Nigerian, you may be familiar with the slang term “Enipe,” which gained popularity in 2022. Some people may assume that Earnipay’s name was inspired by this slang term, but it is important to note that Earnipay has been in existence before “Enipe” started trending. Therefore, the name is not a derivative of the slang term.

Similarly, financial gurus may have heard of the term “Anypay” and may mistake it for Earnipay. However, the two names are not related, and even if there are any similarities, it would be because any day is payday with Earnipay.

It’s also worth mentioning that some people may assume that Earnipay’s name is customizable, similar to how some social media platforms allow users to create customized usernames.

However, this is not the case with Earnipay. The name is a unique identifier for the platform and cannot be customized by individual users, not even Earnypay.

What is Earnipay?

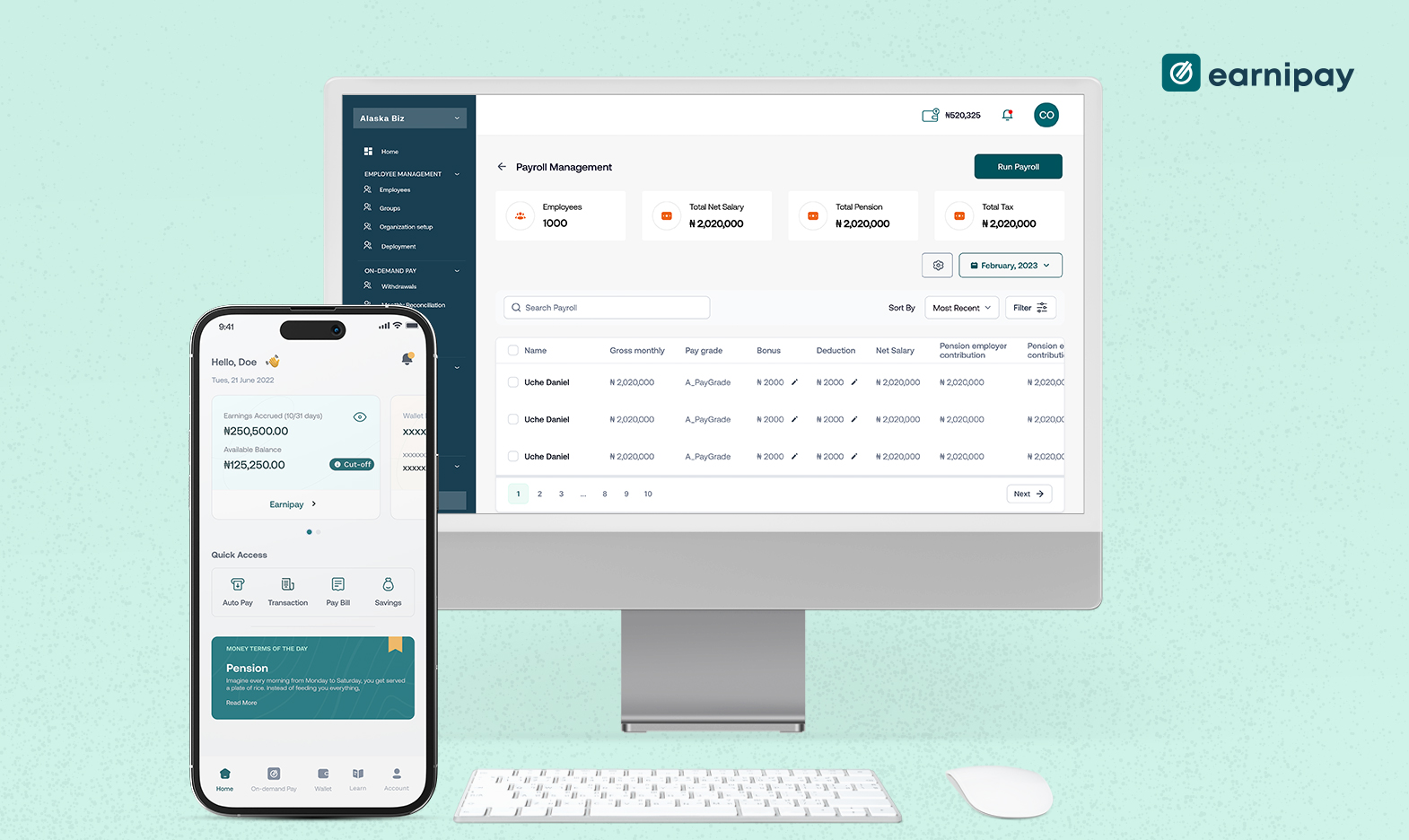

As a finance and people operations company, Earnipay provides businesses with the financial and operational support needed to succeed through the provision of financing and top-notch technology solutions, resulting in optimal outcomes.

Imagine you’re the owner of a small bakery, and your business has been growing steadily over the past few years. However, as your customer base is expanding, you’re finding it increasingly challenging to manage your finances and people operations. That’s where Earnipay comes in!

Our range of product offerings is designed to make the day-to-day operations of your organization or business run more smoothly and efficiently, providing you with the support you need to succeed.

What Product Does Earnipay Offer?

Our product offerings cater to both employees and employers, ensuring that everyone can benefit from our solutions.

Earnipay Solutions For Businesses

Invoice Financing:

Earnipay’s invoice financing solution provides a financial solution that allows businesses to access immediate funds by converting outstanding invoices into cash. Through this system, Earnipay pays up to 80% of the invoice amount, giving businesses the ability to pay suppliers and cover operational expenses without any interruptions caused by payment delays. This solution is particularly useful for businesses looking to improve their cash flow by swiftly converting unpaid bills to cash.

Payroll Processing and Financing:

The calculation and distribution of your employee’s salaries and wages are part of the payroll administration process. This includes calculating pay based on the number of hours worked, deducting taxes and benefits, and sending checks or direct deposits. Alternatively, financing entails using money to help your business through investments or loans. Our product combines these two sectors by delivering finance choices to assist your business’s operations as well as tools and services for effective payroll management.

Bulk Bill and Vendor Payment:

Your business can pay a large number of suppliers or invoices with Earnipay’s Bulk Bill & Vendor Payment option in a single transaction. This feature makes the payment process more efficient, saves time, and requires less work. Businesses can manage their payment operations more effectively, save time, and cut expenses by using Earnipay’s Bulk Bill & Vendor Payment function. By doing away with the requirement for separate payments, this feature provides a quicker and more effective way to manage many payments at once.

Earnipay Solutions For Employees

On-demand Pay:

Our On-demand Pay solution is a game-changer for employees who need more flexibility and control over their finances. It provides employees with instant access to their earned salaries and helps them avoid the stress and anxiety of waiting for their next payday and this is a great employee benefit every employee would love. Once this system is functional at your place of work, you can easily access your earned salary using our USSD code, mobile app, or web app. Want to know how this works with Earnipay? Check this. In case you do not know, this is not a LOAN!

Autopay:

With autopay, users that are enrolled with Earnipay can automatically withdraw their earnings on a daily or weekly basis. With this feature, users can set a specific schedule and amount for their earnings to be transferred directly into their verified bank accounts, without having to do it manually unlike the On-demand pay solution. Autopay offers users the flexibility to receive their earnings at a reduced cost of up to 35% compared to the regular Earnipay withdrawal fees. This means that users can enjoy the convenience of having their earnings automatically transferred into their bank accounts, while also benefiting from significant savings on withdrawal fees.

Wallet:

Earnipay’s digital wallet provides a secure and convenient way for users to store and manage their money. With multiple funding sources, instant payments, and attractive rewards, the wallet reduces the need for cash transactions. The wallet also offers robust security features, ensuring users’ funds and personal information remain safe.

Bill Payment:

Earnipay’s bill payment feature is a convenient solution that allows you to pay your bills directly from your wallet. With this feature, you can avoid the hassle of manually paying your bills and can instead make payments easily and securely through the app. Earnipay supports a wide range of bill payment options including electricity bills, cable TV subscriptions, and more, making it a one-stop for managing your finances.

LEARN:

In today’s fast-paced world, having a good grasp of financial literacy is crucial to achieving financial stability and freedom, regardless of age. Understanding the fundamentals of managing money, such as budgeting, saving, investing, and credit management, is vital to making informed financial decisions. Through Earnipay’s LEARN feature, you can gain knowledge on various financial topics that are presented in a user-friendly and accessible manner. From basic budgeting to more advanced investment strategies, LEARN is designed to cater to a diverse range of users, whether you are a student, young professional, or seasoned investor.

Savings:

This product is a user-friendly digital platform that will help you achieve your financial goals by allowing you to set and track savings targets effortlessly. We also have the autosave feature that allows you to automatically save your money towards your goals, making it easier to achieve your financial milestones.

Employee Loans:

Earnipay’s employee loan option offers quick, collateral-free loans with flexible repayment terms and competitive interest rates. This feature promotes financial wellness and is accessible to a wide range of employees, making it a valuable feature for those in need of short-term financing for emergency purposes.

In conclusion, it’s important to emphasize that proper spelling helps ensure you land on our correct website and avoid the frustration of obtaining inaccurate information. If you wish to learn more about our product, feel free to visit our website here.

Leave a Comment