In recent times, on-demand pay has gained wide traction in this part of the world. With its increasing popularity, on-demand pay is being rapidly adopted by many organizations, and as such, you can get on-demand pay if you work in Nigeria.

At Earnipay, we are committed to driving the adoption of on-demand pay in Nigeria and Africa at large. Being the foremost on-demand pay provider in Nigeria, our on-demand pay solution is aimed at helping income earners in Nigeria gain access to their salaries whenever they need it.

This article will provide detailed information on our on-demand pay solution, eligibility criteria, and its impressive benefits to help you get started today. Let’s begin.

How does Earnipay’s on-demand pay solution work?

Earnipay’s on-demand pay is an innovative payroll solution that empowers employees with flexible access to their salaries as soon as they are earned. This solution is a much better option than employee loans and comes at no cost to employers.

Earned wages are calculated based on the number of days worked. For instance, an employee with a monthly net salary of N300,000 in a 30-day month would earn N10,000 per day. In five (5) days, the employee would accrue N50,000.

With our on-demand pay solution integrating seamlessly with your employer’s payroll system, you can easily request and receive wages for the days you’ve worked up to a specific limit. As an employee, you have instant access to 50% of your salary; however, your employer can adjust the limit on their dashboard.

Choosing Earnipay means selecting the best payroll management in Nigeria, offering flexibility and financial empowerment for employees while maintaining efficiency and cost-effectiveness for employers.

With ease of use at the forefront of our offerings, you can access your earned salaries either through our mobile app (Playstore or Apple Store), where your salaries are paid into an Earnipay account assigned to you.

How do I qualify for on-demand pay with Earnipay?

Getting access to our on-demand pay solution is straightforward. You can start with us immediately, once your employer meets our eligibility requirements. To get started with our on-demand pay solution, refer your employer here. Your employer would be required to provide;

- Company name

- Registration number

- Total number of employees

- Tax identification number

- Total net monthly payroll

Once this information has been provided, and our team verifies it, your company’s account will be created. Following this, your employer would onboard all employees, then we would send an SMS, inviting you to activate your account.

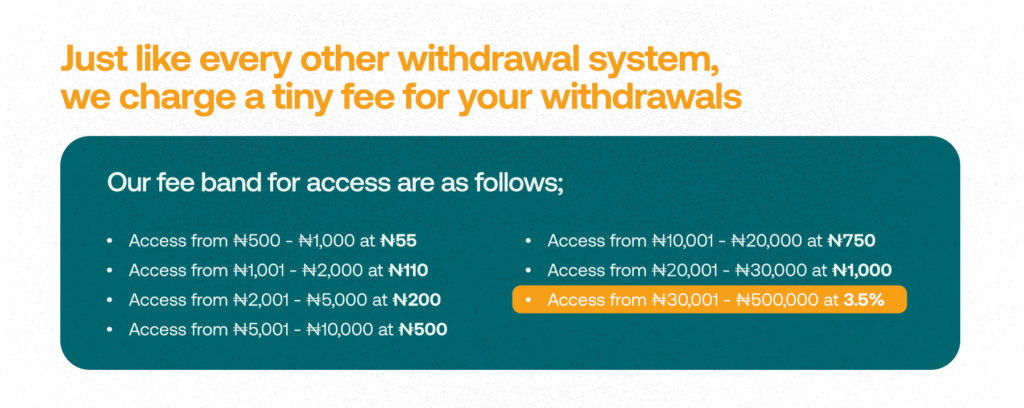

It is essential to state that this benefit comes at no cost to employers. Employees are only required to pay transaction fees without hidden fees or interest rates. Here’s a breakdown of the withdrawal range and the accompanying fees.

Benefits of Earnipay On-demand Pay

Here are some of the benefits employees can enjoy when you take advantage of this solution;

- Real-time salary access:

On-demand pay breaks the conventional 30-day salary cycle by empowering employees to access their earned wages anytime. Therefore, instead of resorting to predatory loans to meet unexpected costs, employees can easily withdraw from their earnings even before payday with earned wage access.

- Low-cost financing option:

On-demand pay is a cheaper alternative than the exorbitant interest rate associated with predatory loans. The best part is that your employer bears no cost to offer this service. Employees would only need to pay tiny fees on withdrawals that vary depending on the withdrawal range. - Improved productivity:

There’s no doubt that money worries cost businesses more money than they can imagine. This is largely due to the causal link between employee financial wellness and their work productively. With on-demand pay, employees can easily withdraw their earned wages to take care of financial needs and become more productive at work.

Finally, On-demand pay is an innovative employee benefit targeted at easing financial stress and helping employees stay on top of their finances. Thankfully, employees working in Nigeria can get access to on-demand pay with Earnipay. Tell your employer about Earnipay today!

Leave a Comment