If there’s anything peculiar to humans, it’s the act of making money. Regardless of how much or how little you’ve amassed, no one takes the foot off the pedal as regards money making. However, there’s a distinct difference between working for money and making money to work for oneself. While the latter implies using your money to make more of it, the former means the exact opposite and it’s quite saddening a handful of people fall under this financial self-rumination umbrella.

According to Marshall Sylver, an author and performance hypnotist — “either make your money work for you, or you’ll always work for money.” Rightly so, you have to take your financial bull by its horn, or you’ll never be free from the shackles of always working with little or nothing to show for it. And mind you, there’s no better way to start making your money work for you than making money passively.

Ready to learn how? Then let’s discuss what passive income is and how it works.

What’s Passive Income And How Does It Work?

Simply put, passive income is a form of income that can be generated without active participation in a business or trade. It’s an income stream that requires little effort to maintain and is often generated through investments or a side hustle. This is the exact opposite of active income; which is income generated from active involvement in a business or job.

However, it’s also pertinent to note that generating passive income isn’t a get-rich-quick syndrome, and as much as active presence isn’t involved, one must put in the work first before the dividends start to abound.

How Passive Income Works

Basically, generating passive income works differently for everyone. This is an individual’s unique decision that just stems from the alignment of skills and interests.

However, if you want to get your money to work for you via passive income, you must first:

- Analyze Your Skills And Interests

Do a deep thinking about your interests, skills and hobbies and you can combine these and turn them into passive income streams. For example, if you see a lot of football matches, and you enjoy talking about the sport, you can venture into ways that turn this into a money-making stream.

- Invest

Whatever you decide and do, you’d have to invest if you’re ever going to milk money from it. Be it time, money or effort — one or all has to be invested for this to work, because while passive income can provide a steady stream of income, it still requires investments to get started.

Remember, it’s equally important to carefully consider any passive income ideas before investing time and money into them. Make sure you understand the risks and potential rewards before taking that leap.

Passive Income Strategies To Make Your Money Work For You

Looking to make your money work for you passively? These strategies could just be the missing link.

- Automated Financing

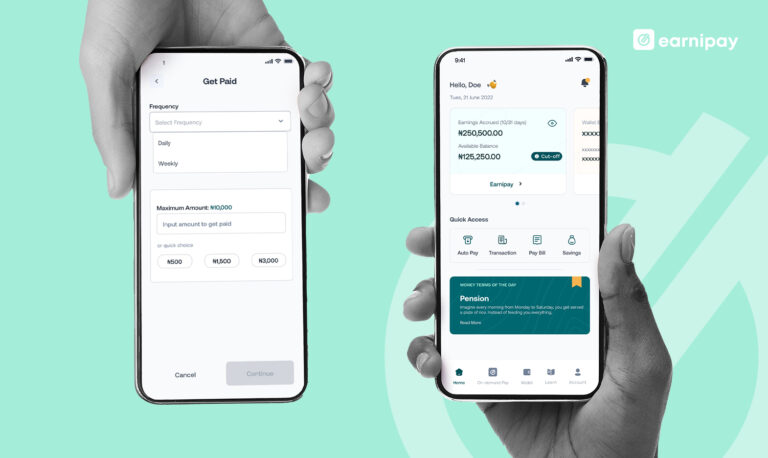

Automating your finances will go a long way in managing your cash flow and save you from stress and hassle. Ranging from your bill payment to others, platforms like Earnipay will go a long way in covering up for you.

- Commit To Financial Goals

If you’re indeed in for making your money work for you, you have to be as disciplined as you can. Whatever it may be — investment, side hustle or savings plans, be 100% committed to planning and executing them.

- Stay Clear Of Debt

No matter how financially savvy you’re or disciplined you’re, if you can keep a tight leash on being in debt, it’ll be near impossible to make your money work for you, as you’ll be robbing Peter to pay Paul most of the time.

To bid final farewell to loans which accrue into debts, you should try out Earnipay’s on-demand solutions, and eliminate the need for loans.

Final Note

Making your money work for you through passive income is an ingenious way to build wealth and achieve financial freedom. By implementing the various strategies discussed above, you can create a steady stream of income that requires little ongoing effort on your path.

Remember that building passive income takes time and effort, but the rewards are well worth it in the long run. Cheers to you earning passively hereon!

Leave a Comment