Banking is a cornerstone of the modern financial system, but it appears that many Nigerians are unaware of the mechanisms behind banks’ revenue streams, how they impact their funds, and the value of their deposits. As a business owner or entrepreneur in Nigeria, understanding how banks make money is key to managing your finances wisely. This article explains how they not only generate revenue but how it impacts your business accounts and introduces alternatives for better returns tailored to SMEs and entrepreneurs.

The Mechanics of How Banks Make Money in Nigeria

1. Interest Rate Margins: The Core Profit Model

One of the primary ways banks make money in Nigeria is through interest rate margins. Banks typically offer low interest on business deposits while lending those same funds to borrowers at much higher rates. The difference between these two interest rates, known as the net interest margin (NIM), forms a large part of banks’ profits.

For example, while a savings account for businesses might offer 1-2% annual interest, banks lend these funds at rates ranging from 15-25%. According to the Central Bank of Nigeria’s (CBN) Financial Stability Report 2022, the average net interest margin for Nigerian banks was around 7% in 2022. This margin highlights how much banks earn from lending out deposited funds at higher rates.

2. Fees and Charges: A Steady Revenue Stream

Apart from interest margins, Nigerian banks also rely heavily on fees and charges to generate income. Business accounts, in particular, are subject to various fees such as monthly maintenance fees, transaction fees, and overdraft penalties.

A report from the Nigeria Deposit Insurance Corporation (NDIC) shows that in 2022, Nigerian banks collectively earned around ₦250 billion from fees and commissions. These fees add up, especially for businesses with frequent transactions, often significantly affecting their cash flow.

3. Investments: Banks Leveraging Deposits

Another way Nigerian banks make money is by investing customer deposits in high-yield financial products like Treasury Bills and government bonds. Banks use deposits from business accounts to invest in instruments that yield much higher returns than what they pay depositors.

For example, Federal Government Treasury Bills offered an average return of about 10% in 2023, while most business savings accounts paid only 1-2% interest. This spread provides banks with significant profits, further increasing their income from investment activities, as highlighted in the CBN’s Annual Report.

How Banks Make Money – The Impact on Your Business Savings

As inflation in Nigeria continues to hover around 20% annually (according to the National Bureau of Statistics), the low interest rates provided by traditional banks fail to keep up. This causes the real value of savings in business accounts to decline over time. Additionally, high fees further erode any interest businesses might earn, making it difficult for SMEs to grow their capital efficiently.

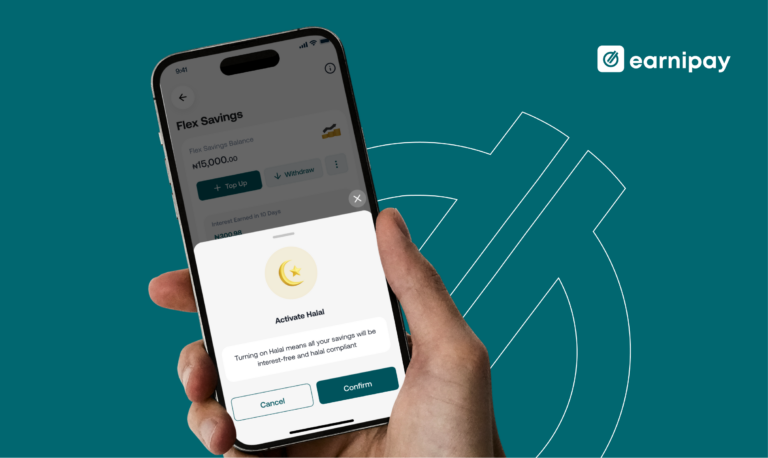

An Alternative That Works: Earnipay High-Yield Business Accounts

In response to the challenges of traditional banking, alternatives like Earnipay High-Yield Business Accounts have emerged, offering more favorable terms for business owners and SMEs. These accounts are designed to give better returns and offer more transparency in how they operate.

This account offers daily interest accrual and market-leading rates, designed specifically to address the needs of those that have traditionally been underserved by conventional banks.

Maximizing Financial Growth for Your Business

Understanding how banks make money in Nigeria helps business owners make better decisions about where to place their funds. Traditional banks profit from interest margins, fees, and investments, often at the expense of depositors. However, solutions like Earnipay High-Yield Business Accounts offer more competitive interest rates, transparent fee structures, and daily interest accrual, helping businesses grow their capital more effectively.

By choosing the right financial products, SMEs can ensure that their money works harder for them, providing better returns and supporting long-term growth.

Leave a Comment