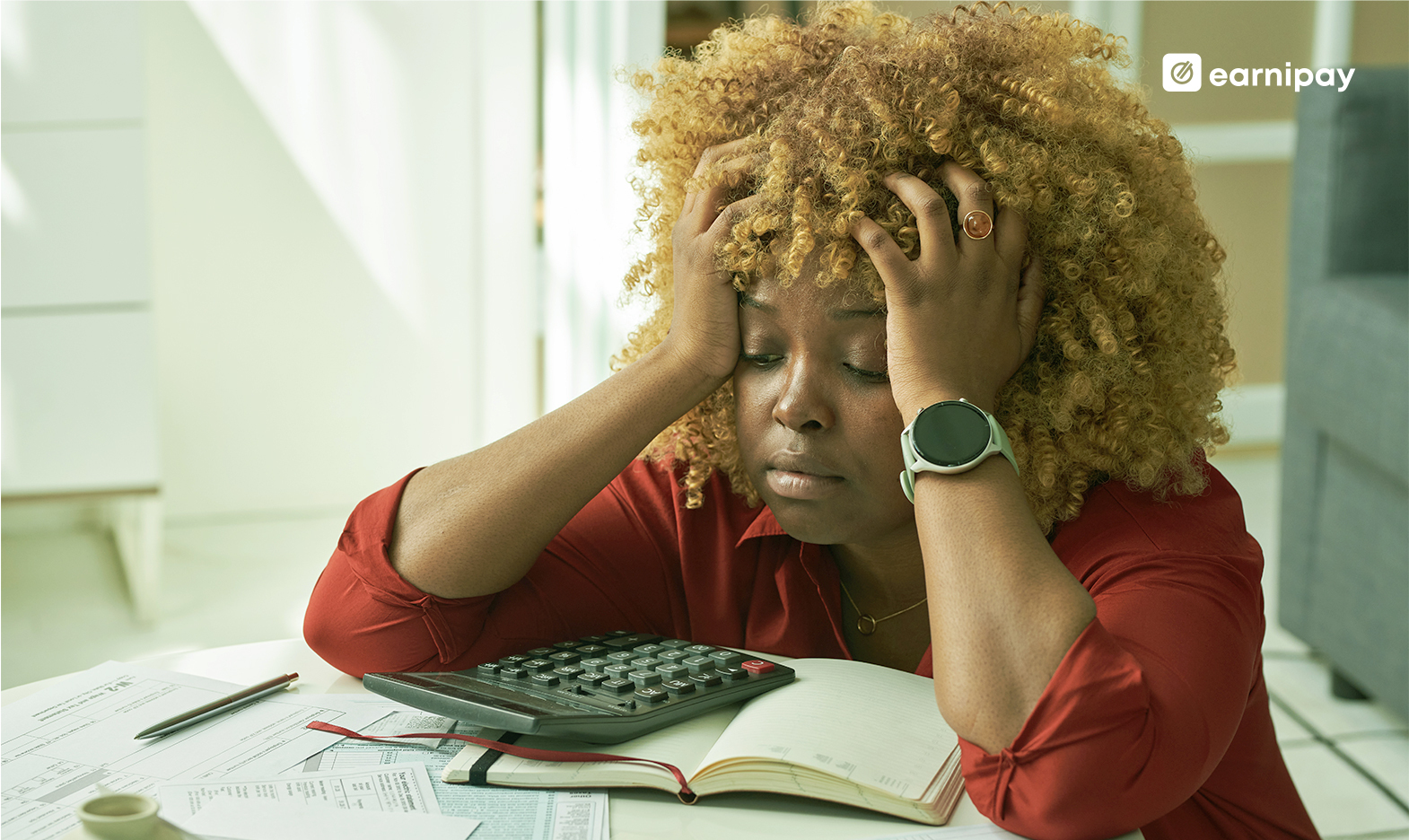

Every day, millions of people in Nigeria stress about money. This happens across the globe as well. In 2023, the American Psychological Association’s 2022 Stress in America Survey revealed that 83 percent of people said they were stressed out by inflation. In Nigeria, the headline inflation rate increased to 33.20% in March compared to 31.70% recorded in February 2024.

This stress is all too common; with each visit to a supermarket, each shopping trip, and each billing cycle. As we see the ups and downs of our bank accounts, this worry takes a toll on our mental well-being.

From managing debts to coping with sudden job loss, unexpected family responsibilities, and even poor lifestyle habits like gambling or impulsive spending, it’s almost impossible to not be stressed about money. Many of these situations tend to be beyond our control, but recognizing the root causes of financial stress is the first step towards regaining stability.

Money on Your Mind?

For many, the pressure to stay afloat is suffocating, whether it’s struggling to cover necessities or drowning in debt. This cycle of financial stress and reduced earning potential only serves to weigh on our mental health.

Recent studies have uncovered a troubling connection between financial worries and a range of physical and mental health issues. Anxiety and depression, common outcomes of financial stress, are just the tip of the iceberg. Research now links money concerns pain and inflammation, heart disease, high blood pressure, headaches, insomnia, ulcers, back pain, arthritis, and asthma.

This financial strain isn’t limited to individual health; it extends to broader societal implications. Life challenges, such as divorce, disability, caregiving, illness, and bereavement, financial strain emerged as the most detrimental factor to overall health, according to a study conducted by British researchers. The stigma surrounding financial struggles or “being broke” often makes it harder for individuals to seek help and support.

Here’s another thing about money worries: it’s not confined to our wallets. It spills over into our work lives. Missed deadlines, decreased efficiency, and even skipping work become all too common, further risking our income and career prospects.

How to Manage Financial Stress in Nigeria

- Financial Planning: Create a comprehensive financial plan that maps out your current financial standing, income, expenses, goals, and strategies to achieve them. A well-designed financial plan serves as a roadmap to guide your financial decisions and track your progress toward your goals.

- Budgeting: Develop a realistic budget that aligns with your financial goals and lifestyle. A budget helps you allocate funds for savings, spending, and debt repayment, ensuring you live within your means without feeling deprived.

- Building Emergency Funds: Establish an emergency fund to cover unforeseen expenses and financial emergencies. Aim to save three to six months’ worth of income in a dedicated savings account, gradually contributing to it with tools like Earnipay’s Savings Plan.

- Seeking Financial Support: Don’t hesitate to seek financial assistance when needed, whether it’s through work benefits, salary advances, or support from loved ones. Pride should never stand in the way of securing your financial well-being during challenging times.

- Stretching Your Budget: Maximize your purchasing power by taking advantage of discounts, deals, and incentives retailers offer. Practice smart spending habits, such as buying in bulk, bargaining, and using coupons, to make the most of your budget.

- Self-Care: Prioritize self-care activities to alleviate stress and maintain your physical and mental well-being. Engage in activities like meditation, exercise, spending time with loved ones, and pursuing hobbies that bring you joy and relaxation.

- Seeking Professional Help: Consider consulting with a financial advisor or mental health professional if you struggle to manage your finances or cope with stress. A financial advisor can offer personalized guidance on financial planning and investment strategies, while a mental health professional can provide support and coping strategies for managing stress effectively.

Leave a Comment