Getting started on Earnipay is designed to be simple and secure, making sure that every step of the way, your financial information is safe.

Completing your KYC (Know Your Customer) verification is key to accessing all the features and benefits Earnipay has to offer.

Let’s walk through each step to get your account set up and ready to go.

Getting Started With KYC

Step 1: Download the Earnipay App and Start Signup

A. Download the Earnipay App

Start by downloading the Earnipay app from your app store.

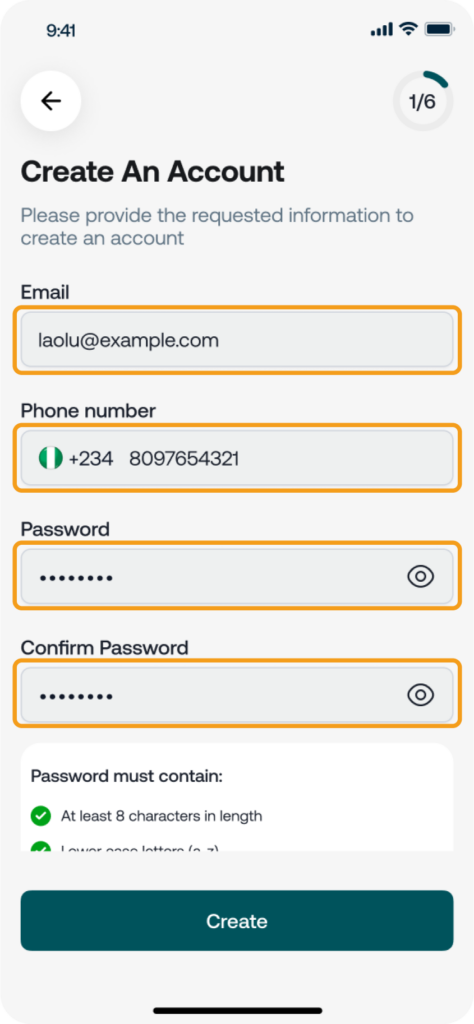

Open the application and begin signing up by entering your email, and phone number, and creating a secure password.

B. Verify Your Email

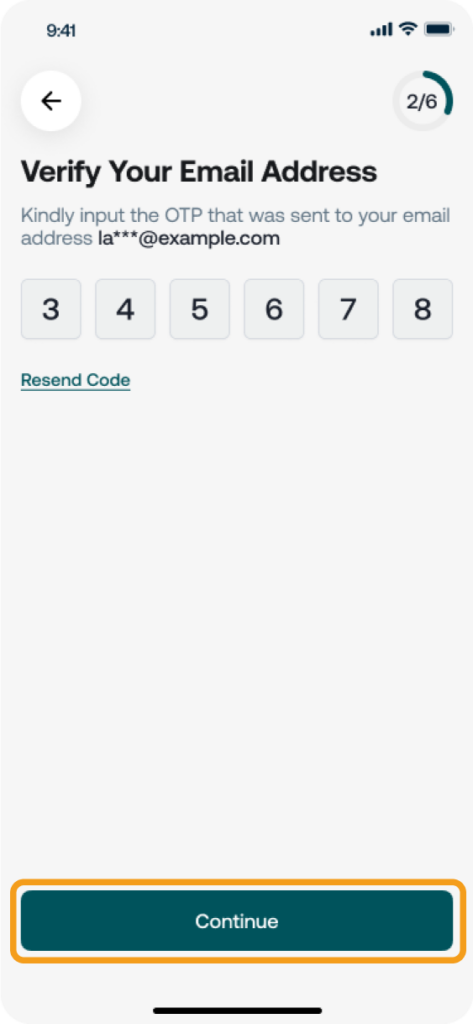

After submitting your email, you’ll receive a one-time password (OTP) in your inbox. Enter the OTP to confirm your email and proceed.

Step 2: Enter Your BVN and Other Basic Details

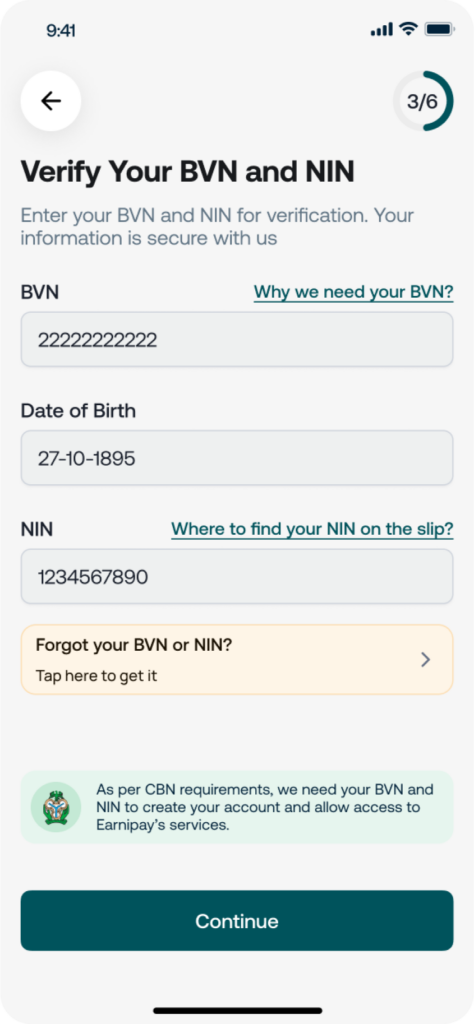

To comply with regulations and ensure account security, setting up an Earnipay account requires your BVN (Bank Verification Number) and some additional details:

A. Enter Your BVN and NIN

You’ll be prompted to enter your BVNBank Verification Number) and NIN (National Identification Number).

Make sure these details are accurate, as they are crucial for completing your KYC on Earnipay.

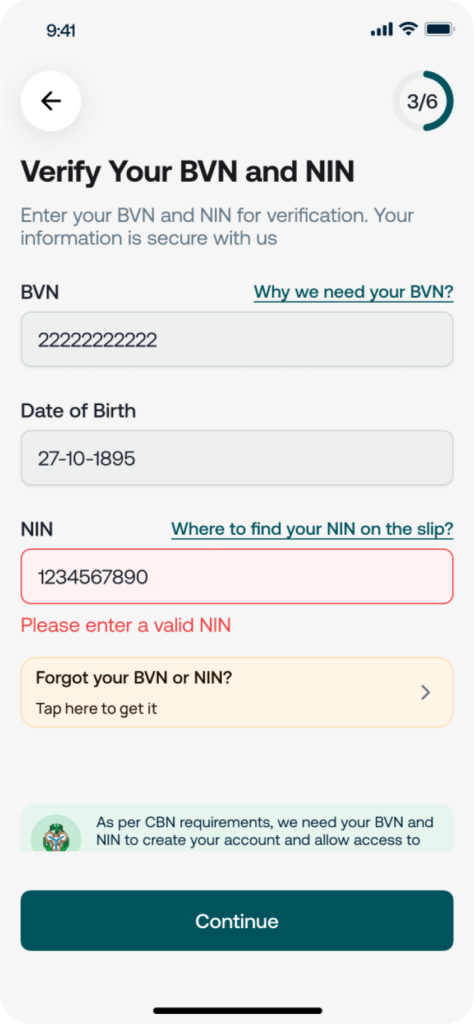

B. Double-Check Information

Ensure all details are correct before moving forward. For any issues with your BVN, contact your bank for assistance.

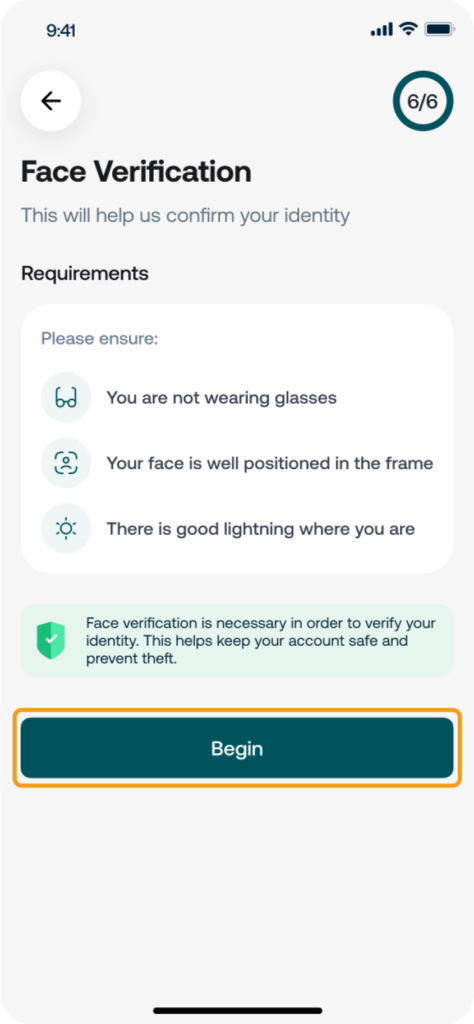

Step 3: Face Verification

Face verification adds an extra layer of security. This process confirms your identity and helps protect access to your Earnipay account.

A. Capture a Clear Image

Find a well-lit space and take a clear photo. Make sure there are no shadows or glares. If needed, retake the photo for clarity.

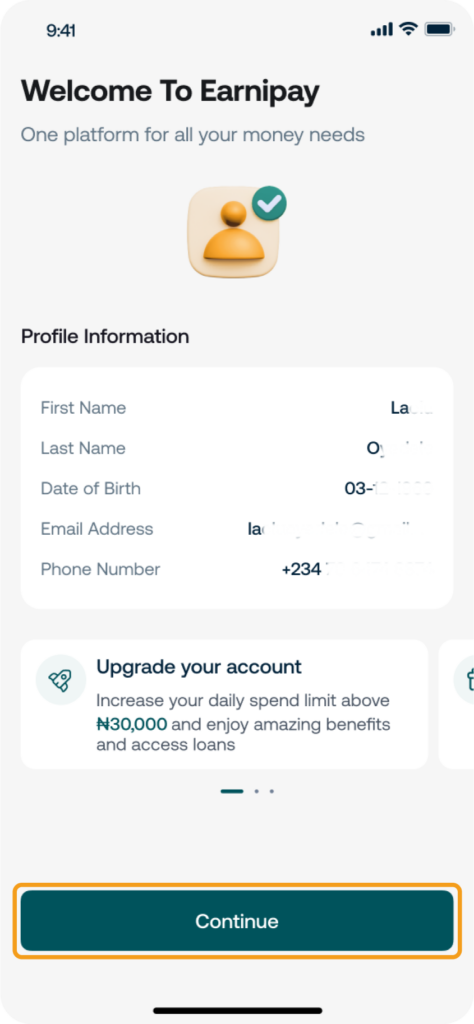

Step 4: Submission and Confirmation

Once the previous steps are complete, submit your details for verification.

The verification process may take a few minutes. After successful verification, your Earnipay account is ready.

Completing your KYC is just the beginning. To learn more about accessing loans through Earnipay, click here to find out how to apply for your Earnipay Personal Loan.

Need Help?

If you need assistance or have questions about creating an Earnipay Personal account or completing your KYC, our support team is here for you. Simply click here, or email us at support@earnipay.com—we’re happy to assist.

Taking these steps today brings you closer to a secure financial future!

Leave a Comment