Managing your money efficiently can often take a backseat to the demands of a busy work life in a world where time is a precious commodity that can’t be regained if lost. In the same vein, money management is a crucial aspect of everyone’s life, which, if neglected, could backfire heavily on one’s finances.

As a busy employee, you need a practical solution to help you take charge of your finances without having to shed your already preoccupied time. The great news is the digital era has ushered in a new wave of money management apps designed specifically for busy employees like you. These apps are not only convenient but also powerful tools that can revolutionize the way you handle your finances.

Yet, finding the right money management app isn’t all that rosy; that’s why we’ve curated a list of the top 10 money management apps specifically tailored to meet the needs of busy employees.

In no particular order, here’s a list of the top 10 money management apps to assist you with your financial planning.

Top 10 Money Management Apps

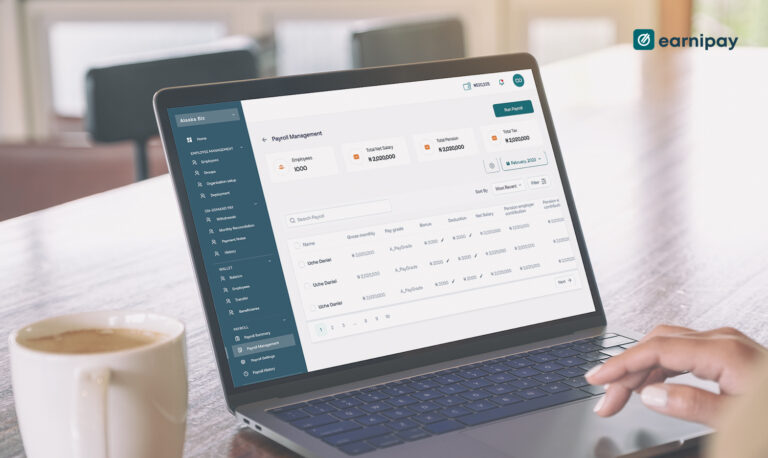

- Earnipay: Managing your finances can be difficult, but with Earnipay, it can’t get any easier. The Earnipay app comprises top-notch financial tools to help you automate your finances. From daily access to your earned pay, bill payments, savings, or financial education, to getting on board, Earnipay is simply the best money management app to make your finances easier and more secure. Get started here.

- Mint: Mint is a renowned personal finance tool that consolidates all your financial accounts in one place. It tracks your income, expenses, bills, and investments, providing a holistic view of your finances. With Mint, you can set budgets, receive bill reminders, and get personalized money-saving tips, making it an invaluable tool for busy employees

- Acorns: Next on our list is Acorns, a multi-investment and money management channel for all and sundry. The app rounds up your daily purchases to the nearest dollar and invests the spare change into diversified portfolios. This “micro-investing” approach is perfect for busy employees who want to grow wealth without diving into complex investment strategies.

- Monefy: Monefy is a user-friendly app that helps you track and manage your expenses effectively. With its detailed transaction list, you can easily monitor your spending. The app also supports multiple currencies, making it convenient for international users, and allows you to manage multiple accounts seamlessly.

- Wally: Wally is an expense-tracking app that can also cater to the needs of busy professionals. It allows you to log your expenses manually or by scanning receipts, categorizes your spending, and provides insightful charts and reports. Wally’s sleek design and user-friendly interface make it a go-to app for those seeking simplicity and efficiency.

- Expense Manager: This is an exceptional app that offers all the features of the top expense tracker apps in the market. Its user-friendly interface is complemented by convenient built-in tools such as a currency converter, loan calculator, and interest calculator.

- PocketGuard: PocketGuard is a user-friendly app that simplifies budgeting for professionals on the go. By connecting to your bank accounts and credit cards, PocketGuard analyzes your spending patterns and helps you set realistic budgets. It also provides insights into your spending habits and alerts you when approaching your budget limits, ensuring you stay on track.

- iSaveMoney: This a visually appealing app designed to assist you in tracking your expenses. Its intuitive interface allows you to easily manage your budget and set up recurring payments for effortless bill management.

- Clarity Money: Clarity Money streamlines your financial life by providing a clear overview of your finances and suggesting ways to save money. The app helps you identify and cancel unwanted subscriptions, negotiates lower bills on your behalf, and even monitors your credit score.

- Moneyview: Lastly, but definitely not the least of our top 10 management apps for busy employees is Moneyview. This is a money management app that offers you instant access to your financial information. The app automatically updates your financial report by analyzing the financial data contained within your SMS messages related to transactions, eliminating the need for manual data entry.

Endnote

In conclusion, the top 10 money management apps discussed in this article are valuable tools for busy employees seeking to improve their financial well-being. By leveraging the power of technology, you can simplify managing your finances, save time, and make smarter financial choices.

Whether it’s tracking expenses, creating budgets, or planning long-term goals, these apps provide the tools and resources to help you achieve financial success amidst your busy schedules. Embracing these money management apps can empower you to take charge of your finances and pave the way for a more secure and prosperous future.

Leave a Comment