Everyone needs to be financially literate as it guarantees a healthy financial life. For this reason, it is essential to take financial education seriously. You do not want to run into massive debt because of your ignorance. Financial literacy can also help you achieve your financial goals easily. Your dream of building a mansion and driving a Porche car can be possible with proper financial education.

An individual’s financial literacy is essential, but one must be careful where they get their financial education. The best financial education is from reputable financial institutions like Earnipay, with a proven track record in business and people’s finances.

This article serves as a guide to managing your money while teaching you how to use Earnipay’s educational resources to improve your financial literacy and financial life.

What is Financial Literacy?

According to Investopedia, financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. Having good financial education is paramount for someone aiming for financial freedom. You must manage your money effectively to achieve your financial goals.

You must know how to budget, save, spend, and when to make big purchases to manage your money effectively. You must understand that you must settle your bills on time to avoid overwhelming debts. You must know that sometimes you must sacrifice some of your immediate demands and desires for long-term gains. All these come with a sound financial education vital to achieving financial freedom.

What is the Importance of Financial Literacy?

Financial literacy is essential for everyone looking to have a healthy financial life. It helps you plan your finances to reach your financial goals easily. Financial education gives one the necessary tools and resources to achieve a financially secure future.

With the proper financial education, you will avoid falling into the pit of bad debts, bankruptcy, property forfeiture, etc.

Benefits of Financial Literacy

- It prepares you for emergency

Financial education prepares you ahead for emergencies. You will learn to save for the trying times. One can lose their job unexpectedly or encounter a massive blow to their income. Financial literacy will help cushion the effects of these disasters and help them manage their finances effectively.

- It helps prevent catastrophic mistakes

With financial literacy, one can avoid falling into the pits of debt. It guides you on when to take loans and which kind of loan you should take. With the proper financial education, you can manage your loans to avoid accumulating interest which makes loan repayment overwhelming.

- It enables you to reach your financial goals

With the right financial education, one can plan their finances to achieve personal goals. You know how to budget your spending and when to save and invest to reach your goals.

- It helps boost your confidence

Financial literacy gives you the confidence to make the right decision when making major decisions around your finances. With the proper financial education, you already know the possible outcome of every decision you make, so you won’t be afraid to make certain decisions.

How to make use of Earnipay’s Financial Education Resources

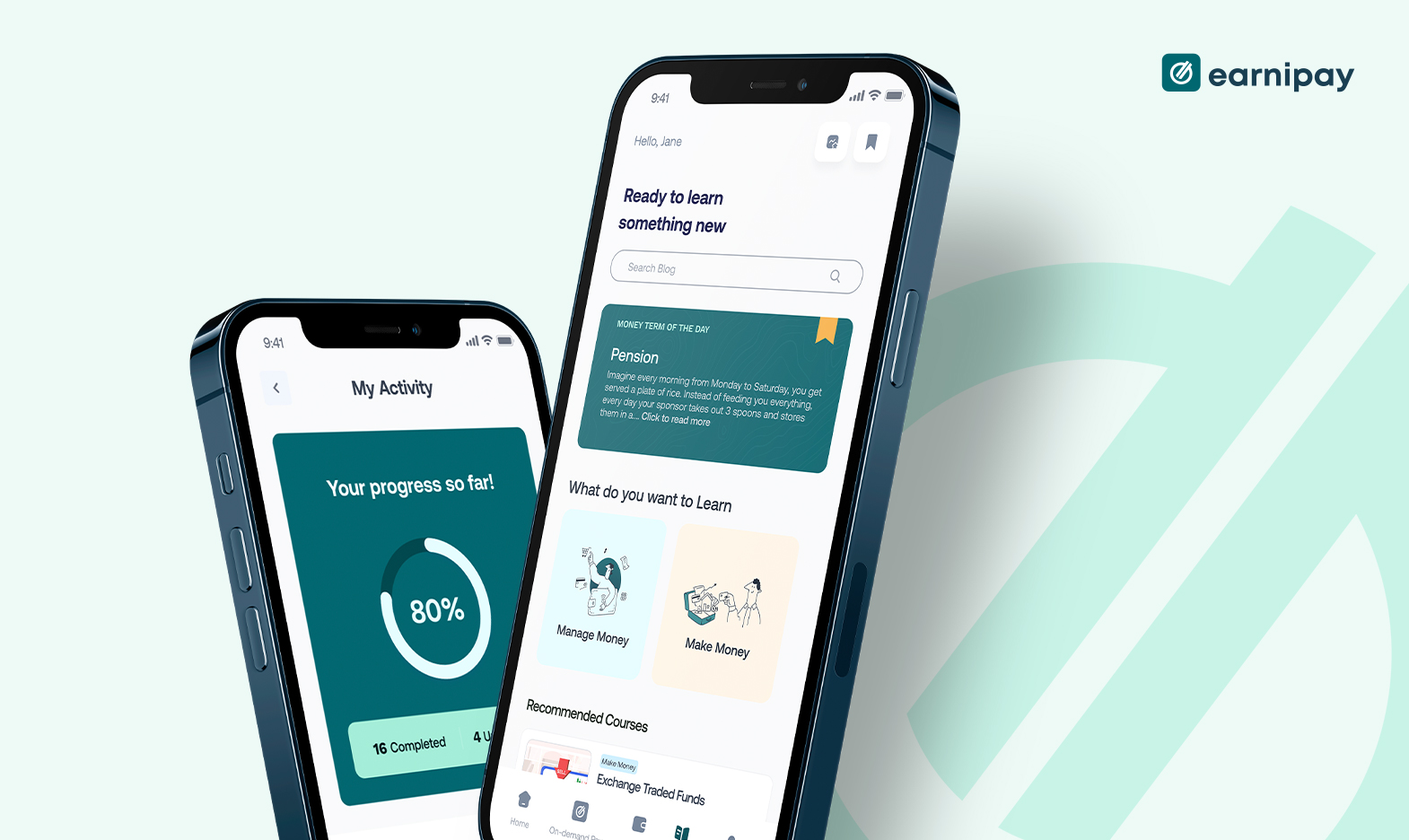

Earnipay is dedicated to promoting financial literacy among its users through its “Learn” feature. Available within our mobile app, this tool offers a range of courses designed to enhance your financial understanding. To access this beneficial tool, download the Earnipay app and navigate to the “Learn” option in the bottom menu. Upon selecting this feature, you’ll be presented with a selection of comprehensive financial education courses. These are designed to empower you with knowledge, fostering a healthy financial lifestyle.

Conclusion

Financial education is essential for every employee. You are making salary incomes that you need to plan for a healthy financial life during and after your time in work service. You need to know when to save, invest, how to spend, and when and how to make the best retirement plans.

With Earnipay’s Learn tool, you can take financial courses that will shape and grow your financial literacy for your good. To learn more about the “Learn” tool, you can tour earnipay.com/employees.

Leave a Comment