As the year draws to a close, you desire to reward your hardworking team with early salaries, enabling them to enjoy the holiday season to its fullest. Yet, the reality of business finances may pose a challenge. Often, your monthly revenues need time to accumulate, typically by month’s end, before fulfilling such desires.

These scenarios are not exclusive to festive seasons. They may also arise in times of unexpected disruptions and crises, reminiscent of the lockdown period in 2020. Amidst these times, you aspire to support your employees, demonstrating your genuine concern for their well-being.

Providing early paydays in response to seasonal demands hinges on having sufficient funds to cover your payroll. However, if your cash flow is tight and you still wish to enable early salary payments for your team, there’s a solution at hand

This article will guide you through the process of navigating seasonal demands using payroll financing.

What is Payroll Financing?

Payroll financing is a method in which businesses seek assistance in the form of capital from financing companies to help finance their employees’ payrolls. All you have to do as a business owner is submit your employees’ payrolls to the financing company and let them pay your employees’ salaries for you; you can repay when you have the funds back.

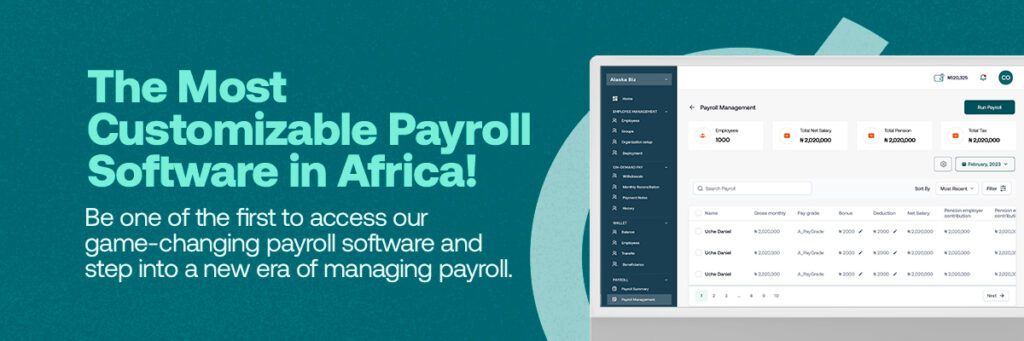

Most payroll financing service providers, such as Earnipay, offer this service for businesses already using their payroll processing service. This way, the financing company already has every payroll detail of your employees and will be ready to finance your payroll.

How does Payroll Financing work on Earnipay?

Earnipay offers payroll financing to businesses already using their On-Demand Pay or Payroll Processing services. We offer up to 100% of the funding required to settle your company’s monthly payrolls for a maximum of 30 days and an agreed processing fee. Earnipay charges a 3% interest rate as a service charge for using the payroll financing service.

To get started, visit Earnipay’s website and locate the payroll financing product. You will find a form to fill out and submit to request financing on the website so long you meet the requirements.

Requirements for Payroll Financing

- Account receivable age schedules.

- Six months bank statement.

- Most recent audited financial statement/management account.

- Irrevocable standing payment order.

- Executed contract agreement.

- Board resolution accepting the facility.

Earnipay conducts a credit check on your business

After you have provided every requirement stated above, Earnipay will conduct a credit check on your business. Here are some credit check activities Earnipay does before they can approve your request.

- Earnipay does a credit search of customers through BVN provided by the directors.

- Earnipay reviews the invoice(s) history to check the possibility of recovery.

- Earnipay checks for evidence of past jobs completed.

- Earnipay does a review of bank statements for inflows analysis.

Earnipay makes a decision

After up to five (5) working days from the day of the receipt of the requirements form, Earnipay decides if you are qualified for invoice financing or not. Here is what the decision-making process looks like;

- The finance department submits a clean credit report to our CEO within 24 hours of receipt of the required documents.

- Earnipay rejects any application that fails the credit check.

- Successful applications get to the CEO for approval.

- The customer gets an executed offer letter/agreement.

Benefits of Payroll Financing

- It helps attract talents

As long as the news about how your company treats its employees gets out, more talents will be willing to apply to your company and work with you. Payroll financing helps ensure you uphold your commitment to your employees’ well-being by allowing you to pay their salaries right on time or earlier in times of seasonal demands.

- Improves business cash flow

With payroll financing, you do not have to divert funds set aside for other business activities to pay your employees’ salaries. You can get the funding you need for their payrolls by requesting and still using the fund you set aside for its original purpose. Payroll financing guarantees a healthy cash flow for your business.

- It helps retain top employees

Employee welfare is paramount in business growth. Your employees feel safe and happy working with you so long they know you care about their welfare. This way, you can keep the top talents and your business growing

There are some periods when there is a need for your intervention in your employees’ welfare. These are periods when they automatically need financial support to get through. This happens mostly at the end of the year and the beginning of a new year. You may need to pay your employees earlier than you used to. But you may not have enough funds to do that, and this is where payroll financing comes in.

With Payroll Financing on Earnipay, you can seek funding for your employees’ payrolls. All you have to do is go to earnipay.com and follow the process for requesting Payroll Financing.

Leave a Comment