Everyone deals with money from day to day. We earn, we spend, we save, and we invest. It’s almost impossible to find anyone that does not need money to survive. But how do we manage how we deal with money? How do we make the right choices with our finances? When do we make purchases, and when do we save? A proper financial education answers every question about money management.

Many people fall into debt just because of their lack of financial literacy. They would have avoided making bad financial decisions if they were well-informed. With the right financial education, you know when to take a loan, if it is needed and how to go about it. Financial education significantly impacts our financial lives, and this article will show you how you can get the best out of your finances with proper financial education.

What is Financial Education?

Financial education is the education that teaches us the skills and approach that makes us more knowledgeable about managing our money. Having the right knowledge about finance helps us plan our spending, savings, and investments to manage our funds effectively and have healthy financial lives.

Financial education helps you avoid disasters caused by mismanagement of funds or making wrong financial decisions. With the proper financial education, you will know what direction you should move with your finances, when to take a loan and when not to, what kind of loan to take, and the best repayment plans for your loans, provided you have to take one.

Why should I be financially educated?

Financial education helps you know things you should know about managing your money and improving your financial literacy. Financial literacy allows one to plan and organise their finances to build a healthy financial life.

We all know the importance of money in life, but we talk less about the adverse effects of making wrong financial decisions. With financial education, you can avoid the negatives that come with the mismanagement of finances, such as depression and bankruptcy.

What are the major areas of Financial Education?

- Budgeting

Budgeting is an estimation of revenues and expenses for a definite period. It simply means a plan to guide the way you spend for a period of time. Financial education teaches you to make the right budget. It helps you make the right priorities count and allocate the right money. With this, you can manage your finances perfectly and save funds.

- Saving

One of the areas of financial education that requires a lot of attention is saving. Financial education prioritises saving and teaches you the right way to go about it. Saving helps you prepare for times of monetary crisis to meet your emergency needs. It also enables you to achieve your long-term financial goals.

- Investing

Investment is the act of committing your money to make profits. Financial education encourages investing. It teaches risk management when investing and helps you choose suitable investment options to maximise your profit.

- Managing your debts

Debt management is an area that people should pay attention to when it comes to their financial education. It is okay to take loans when needed, but you need to know precisely when to take them and how to make the right choices surrounding your loan acquirement process. With this, you can avoid problems with your loan repayment.

- Retirement Plan

You only work for a while for your employer. Every employee has a date due for their retirement. Creating the right plan for your retirement days is one of the best things you can do as an employee. With proper financial education, you can make the best plans ahead of your retirement to avoid financial crises that may occur due to the end of your salary payment.

Take Away

Financial education is paramount to whoever wants to live a healthy financial life. As an employee receiving monthly salaries, it is best to know how to manage your income to avoid financial crises. You should also know how to budget, save, and invest to achieve your financial goals.

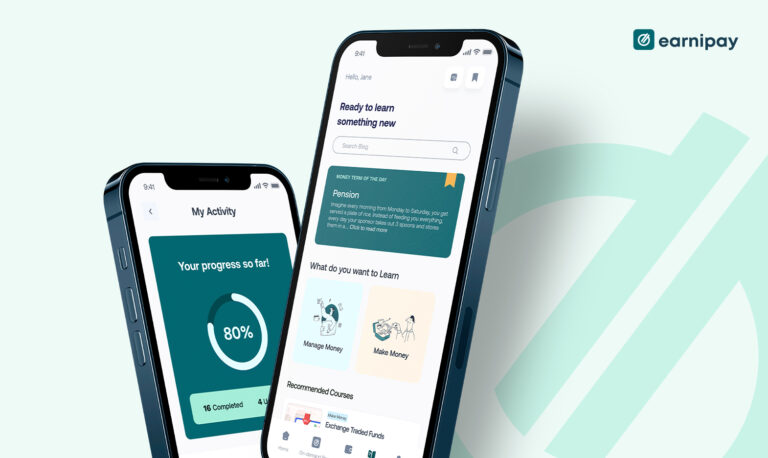

Financial education gives you everything you need to manage your finances correctly. Earnipay’s Learn is a financial education tool on the Earnipay app that exposes users to financial education resources to help them with their finances. You can download the Earnipay app and locate “Learn” at the app’s bottom menu to use the Learn tool.

Leave a Comment