It is known that money worries are the top source of employee stress. According to research by PwC, when employees experience financial struggles, they can hardly “leave it at the door.” In fact, 77% of employees with financial worries admit that they spend up to six working hours a week thinking or dealing with issues relating to their personal finances, resulting in dampened productivity at work.

On-demand pay is here to change the game – On-demand pay is an employee payment method in which employees can receive their wages as they earn them.

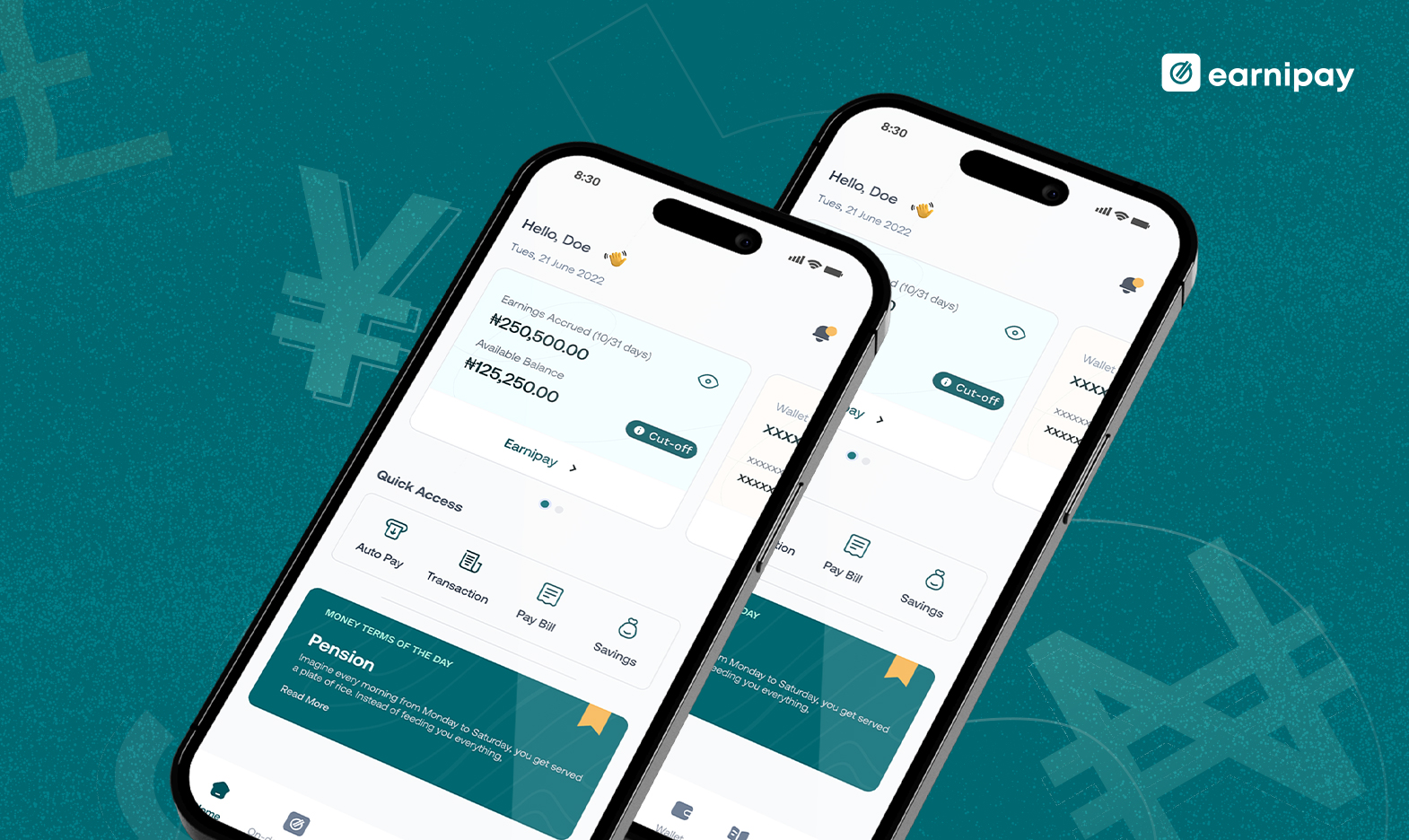

Earnipay on-demand pay

Earnipay is one of the leading solutions changing the game on how salaries are earned.

Earnipay does this by providing a solution that partners with employers to offer employees flexible access to their earned pay. This means that employees can access up to 50% of the money they’ve worked for in their bank accounts at any time before payday.

The pros of Earnipay on-demand pay for employees include:

Quicker payments: With on-demand payments, employees don’t have to wait until their next payday for money. This flexibility allows employees to receive, save and spend their money on their own schedule.

A financial safety net: If an employee is suddenly facing unexpected bills or other urgent payments, on-demand pay can help the employee quickly cover these expenses.

How much is the Eanipay fee?

When it comes to on-demand pay solutions like Earnipay, one of the key questions that employees often have is about the associated fees. Understanding the fee structure is essential for both employers and employees to make informed decisions. Here’s a breakdown of the Earnipay fees based on different access amounts, allowing you to gauge the cost of accessing your earned salary before payday.

Earnipay Fee Structure

Access from ₦500 – ₦1,000 at ₦55:

For employees who need to access a smaller amount within the range of ₦500 to ₦1,000, the fee charged by Earnipay is ₦55.

Access from ₦1,001 – ₦2,000 at ₦110:

If the required access amount falls between ₦1,001 and ₦2,000, Earnipay charges a fee of ₦110.

Access from ₦2,001 – ₦5,000 at ₦200:

Employees seeking access to a range of ₦2,001 to ₦5,000 will incur a fee of ₦200 through Earnipay.

Access from ₦5,001 – ₦10,000 at ₦500:

For larger access amounts between ₦5,001 and ₦10,000, the fee charged is ₦500.

Access from ₦10,001 – ₦25,000 at ₦750:

Employees requiring access to an amount ranging from ₦10,001 to ₦25,000 will pay a fee of ₦750.

Access from ₦25,001 – ₦40,000 at ₦1,000:

Within the range of ₦25,001 to ₦40,000, Earnipay charges a fee of ₦1,000 for accessing the earned salary.

Access from ₦40,001 – ₦50,000 at ₦1,250:

For higher access amounts between ₦40,001 and ₦50,000, the fee charged by Earnipay is ₦1,250.

Why Paying the Earnipay Fee is Worth It

While the Earnipay fee may be a consideration for employees, weighing it against the alternatives is important. Traditional options, such as payday loans, often come with exorbitant interest rates and hidden fees that can quickly accumulate. In contrast, Earnipay’s fee structure is transparent and provides a more affordable option for accessing earned salaries.

Moreover, employees who utilise on-demand pay gain greater control over their finances. They can avoid falling into debt traps caused by high-interest loans and make informed decisions about their spending. By accessing Earnipay’s on-demand pay solution, employees gain peace of mind and the ability to address unexpected expenses or emergencies without resorting to expensive credit options.

It’s also worth noting that the convenience and ease of accessing earned salaries through Earnipay contribute to a more positive work environment. Employees with timely access to their wages can focus on their work responsibilities instead of worrying about financial constraints. This, in turn, can boost productivity and employee morale, benefiting both the individual and the organisation.

Conclusion

While the Earnipay fee represents a small cost, it is a worthwhile investment for employees seeking financial flexibility and peace of mind. The ability to access earned salaries before payday can help employees effectively manage their finances, avoid high-interest loans, and maintain overall financial well-being.

By understanding the fee breakdown of Earnipay, both employers and employees can assess the cost-effectiveness of using on-demand pay and make informed decisions based on their specific financial needs.

Be one of the best companies to work for by taking advantage of this employee benefit. Book a demo with us today.

Leave a Comment