MONEY – It’s something that we all need to survive, yet many of us struggle with it. It’s no secret that financial literacy is not something that is taught in most schools, which means that it’s up to us to educate ourselves on the subject. Trust me, It’s worth the effort.

What is financial education?

Financial education is the process of acquiring knowledge, skills, and resources to manage one’s personal finances effectively. It is a lifelong process that enables individuals to make informed decisions regarding their money, savings, investments, and expenses.

Financial education is important as it helps individuals avoid debt, plan for their financial future, and achieve their financial goals.

Some of the key aspects of financial education include:

- Budgeting:

This involves creating a plan for how to allocate your income and expenses. By understanding your cash flow, you can identify areas where you can save money and prioritize your spending.

- Saving:

It emphasizes the importance of saving money regularly. This helps individuals build an emergency fund, save for major expenses, and work toward their long-term financial goals.

- Investing:

Financial education also covers investing basics, such as understanding different types of investment options, risk management, and portfolio diversification.

- Debt Management:

It teaches individuals how to manage their debt effectively. This includes understanding interest rates, developing a debt repayment plan, and avoiding high-interest debt.

- Retirement Planning:

Financial education helps individuals plan for their retirement, ensuring they have enough savings to support themselves after they stop working.

Why is it important?

Financial education is important for several reasons, some of which are listed below:

- Financial education helps you understand how to manage your money effectively.

Managing finances effectively is a fundamental component of financial education. It involves understanding how to create and stick to a budget, tracking expenses, and developing a savings plan. By managing your finances effectively, you can avoid debt and save for future expenses such as a down payment on a home or retirement.

- It helps you avoid common financial pitfalls.

How often have you heard of someone getting into debt because they didn’t understand how credit cards work? or investing in a risky stock because they didn’t know the basics of investing? many times, right? With financial education, you can avoid these mistakes and make informed decisions to benefit your financial future.

- Financial education empowers you.

Money can be a source of stress and anxiety, but with financial literacy, you can take control of your financial life and make choices that align with your values and goals.

- It improves overall well-being.

Financial education can improve well-being by reducing stress and increasing financial security. By taking control of your finances, you can feel more confident about your future and focus on other important aspects of your life.

Meet Temi, a marketing specialist. Temi’s financial education journey began when she started working her first job. She quickly realized she did not know how to manage her finances effectively and was living paycheck to paycheck. She decided to take control of her financial life by learning more about personal finance. She started by reading books and articles about personal finance, budgeting, and investing. She also attended financial education workshops and took online courses. Through this process, she better understood how to manage her finances effectively and began to make better financial decisions.

How You Can Be Financially Literate with Earnipay

As the world becomes more digital, financial education has become increasingly important. With the right knowledge and skills, you can make informed decisions about your finances, avoid costly mistakes, and achieve your financial goals.

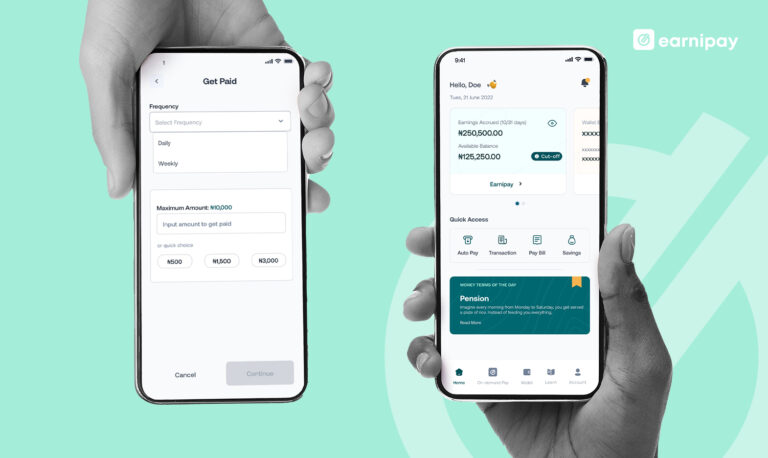

At Earnipay, we have a learning platform for individuals who are interested in taking proper care of their finances and putting it to good use.

LEARN is a free digital financial education platform that offers a variety of courses covering personal finance, investing, retirement planning, insurance, budgeting, and more. The platform provides a series of articles and questions after each article, allowing you to learn at your own pace and test your understanding of the material.

One of the best things about LEARN is that it is completely free to access all courses and articles. This makes it an excellent resource for anyone looking to improve their financial literacy without breaking the bank.

Ready to do better with your finances today? Visit our website to get started with us now!

Leave a Comment