On-demand pay is gaining wide popularity, and this is unsurprisingly due to its prospects of revolutionizing the payroll system by providing employees real-time access to their salaries even before payday!

Let’s take a look at some stats;

- According to a PWC Survey, 18% of employees say that financial stress has affected their productivity at work, while another 15% of workers have been absent from work due to financial worries.

- In Nigeria, more than 80% of the working populace lives from paycheck to paycheck.

- 60% of US workers want daily access to earned wages.

- According to Forbes, 74% of users say access to their earned wages has helped reduce their financial stress 70% of users say access to their earned wages has helped them avoid taking out a payday loan.

From the above statistics, it is clear that on-demand pay is a ready solution to your employees’ financial worries. As an HR manager or business owner, it’s almost impossible to not be sold on on-demand pay given its enviable prospects. But before you go on to add it to your employees’ benefits, you must understand how it works and the benefits it offers to your employees before going ahead to implement it.

What is On-demand Pay?

On-demand pay is a payroll service that allows employees to access their earned wages on demand. It is not a loan or a salary advance. With on-demand pay, employees can tap into the wages they’ve earned without having to wait for payday. Interestingly, while your employees would have access to their earned wages at any time, your payment schedule remains intact, and you will be able to set maximum limits on the amount withdrawable.

Here’s how on-demand pay works: First, you need to sign up with a reliable on-demand pay provider. Because on-demand payments are managed through the payroll system, you can rest assured that taxes and other deductions have been made without requiring any additional effort from your end.

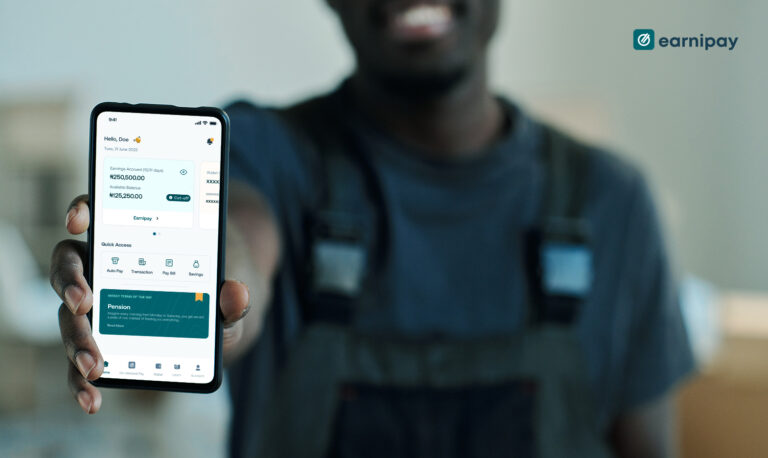

With on-demand pay, employees no longer have to resort to borrowing from loan apps since they can access their salaries on a self-service portal like the Earnipay app to take care of emergencies.

What are the benefits of offering on-demand pay to your employees?

On-demand Pay is a major driver of employee satisfaction due to the amazing benefits that it offers. Here are some ways your employees can benefit from introducing on-demand pay;

- Financial flexibility

Biweekly or monthly payroll is something we’ve had to deal with for a long time even though we were not comfortable with it. a. However, on-demand pay is changing the narrative by providing employees with much-needed control over their finances. With on-demand pay, your employees can know how much they make every day and the number of deductions made and can also assess their earned wages anytime before payday.

- Talent Attraction and Retention

We are currently in a world where benefits equal compensation in terms of the emphasis new talents place on deciding where to work. Therefore, offering this benefit could give your company a competitive advantage. According to EY research, companies that pay on-demand are 2-2.5 times more appealing to candidates. Also, offering these benefits could help improve your employee loyalty. According to surveys, 79% of workers say knowing they can access their wages whenever they want would influence their decision to work for a specific company.

- Alleviate financial stress

It is common for your employees to have pressing needs or emergencies to settle before the end of the month and having little in terms of cash can take a toll on their mental health and productivity. On-demand pay can help promote employee wellness in many ways. First, it can help them match their daily expenses with their earnings and take care of needs that might arise without having to rely on payday loans with outrageous accruing interests.

- Safety net

Having savings set aside for emergency purposes is important. However, there are times when your employee might have little in terms of savings to cover the unexpected challenge. By providing the possibility of earned wage access, your employees have a safety net they can resort to. In addition, on-demand pay offers a cheaper and faster solution compared to other forms of loan. First, there are no interests attached to your employees using on-demand pay; they online have to pay a small fee. Also, they can have their transaction processed within 1-2 working days.

If you’ve read up till this point, you’d agree that on-demand pay is a necessary addition to the HR sector and provides a long-lasting solution to the ever-evolving issue of financial stress. Now that you understand what it’s about and how your employees can benefit from using this service, it’s time to get started. With a reputable on-demand pay provider like Earnipay, you can get started and customise it to suit your company’s peculiarities without spending a dime.

Leave a Comment