Your financial needs are overwhelming, and it is hard to save from your salary at the end of the month. Today, just like every other day, you have bills to sort again. But your salary only comes by month’s end. It is either a financial saviour that comes from above for you, or you crawl back to your payday loan apps.

Well, if you ask us, we would say your hard work deserves better treatment than this. Your toiling should be rewarded with great financial wellness. Working throughout the month every day should be able to allow you to sort your daily bills and financial needs too.

You don’t necessarily need to wait till payday before you settle your basic needs. Imagine when you have emergencies to sort too. It wouldn’t be nice to be caught without a moderate sum of money to tend to them. Hence, On-demand pay is the closest thing to God sending financial saviours from heaven.

But you won’t know this until we show you:

- What On-demand pay is,

- Benefits of On-demand pay,

- The best On-demand pay platform out there,

- And how to get started with it.

So, let’s begin.

What is On-demand pay?

On-demand pay is a kind of payroll system in which employees get access to part of their salaries before the normal payday. It allows employees to gain better financial wellness as they get to sort their bills without taking any payday loans from untrusted loan apps. On-demand pay works like an advance payment on an employee’s perspective pay. Some systems allow for daily On-demand pay withdrawal while some give varying modalities and day frequency to it.

Benefits of On-demand pay

- Free from payday loans and interests: You don’t have to worry about exhausting your salary on unnecessary loan interest again. On-demand pay eliminates your need for payday loans as a salary earner. It affords you access to your earned salaries before payday. Who doesn’t like this kind of ease? Definitely shouldn’t be you.

- Boosts financial wellness: When you don’t have to worry about loans and interests anymore, you tend to think about your money and its usage in a more profitable way. You get the chance to maintain healthy finance management when you sort your bills with On-demand pay whenever they come up.

- Increased work productivity: No one delivers at work optimally with worries of loans and unsettled bills. On-demand pay gives you the luxury of focusing more on your work than other unnecessary things like payday loans, bills and interest.

- Eases payroll loads on employers: You simultaneously boost your business’s financial health as you give your employees access to On-demand payment options. You get to reduce your end-of-the-month payload with this feature, as most employees are open to taking the On-demand pay option than payday loans from external bodies.

The Best On-demand pay Platform for You

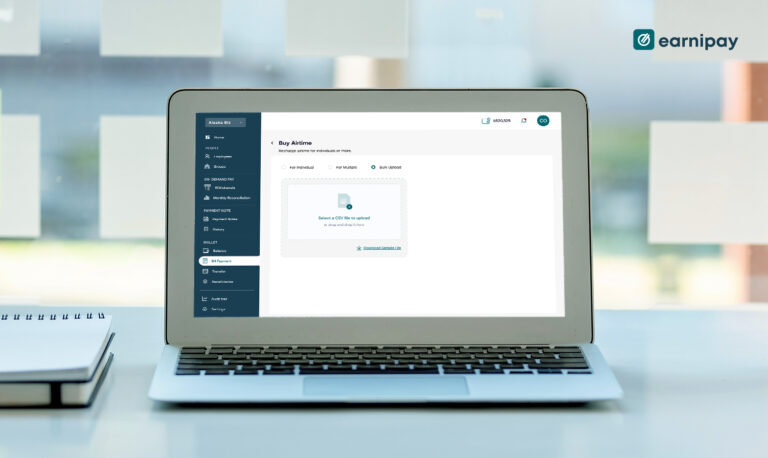

We have done our thorough research, and one conclusion we have is that Earnipay’s on-demand pay feature is the best On-demand pay option for you and your employer. This system directly allows you, as an employee, access to your earned salaries from at least 5 days of work into the month. This On-demand pay option gives employees access to 50% of their earned salaries.

This way, you get to sort reasonable parts of your bills and still save for the end of the month. Simply put, you don’t access all of your earned salaries to have something to go home with at the end of the month too. You get to strengthen your financial wellness with the Earnipay on-demand pay solution and also boost your work productivity as well.

All you need do to enjoy this ease is to inform your employer about this fantastic way to ease your financial payday struggles. Show them the Earnipay website for a full view of their On-demand payment option. Once they integrate it into their payroll system, you can easily request part of your earned salary as due. Then, we have a win-win situation for you and your employer. You sort your bills and live financially well; your employer eases financial payloads for themselves.

How to Get Started on Earnipay On-demand Pay System

The on-demand pay feature is extensively easy-to-use. There is no need for any technical knowledge for your employers to adopt this solution. Employers should follow these simple steps to begin enjoying this rare ease of On-demand payments.

- Visit the Earnipay on-demand pay page here.

- Create an account as an employer with the right requested information.

- Once your account is verified, start adding your employees appropriately.

- You can then group your employees on the platform for ease of management. Although it is not a compulsory step.

- Your employees will get an email invitation to activate their accounts. So, direct them to accept your invitation and onboard appropriately.

- From here, you can set withdrawal limits specifically for each employee.

- You can also track and manage all the payroll information on this segment.

Easy peasy, right? Well, they had you in mind while building this. Hence, you would experience utmost ease while using their On-demand pay feature.

Wrapping up

As an employee that is ready to bid goodbyes to your payday struggles, the only thing you have to do is share this article and available information with your employers. Once they see how much help the Earnipay on-demand pay system can offer you and them personally, they can easily help you make it happen.

Fortunately, you can also enjoy other financial and people operational benefits by using other efficient solutions Earnipay has made for you and for your employers too. Simply go here to see more relevant solutions from them.

Leave a Comment