With technological advancement, nearly every aspect of our lives has experienced rapid changes, and HR management is not left out. Automation is becoming the new normal, and this decade has undergone a massive shift from manual human resources activities to a more automated operation. As a result, HR professionals can get administrative tasks like payroll processing done automatically and focus on strategizing on improving people’s processes in their respective organizations.

In this article, we will discuss one of the trends in payroll processing, with particular reference to automation and its role in improving payroll efficiency. Be sure to read till the end.

Can Payroll Processing be automated?

Yes, organizations can now automate payroll processing in Nigeria. With an automated Payroll system, you can calculate your employee salaries, make necessary deductions, and make prompt payments in minutes with minimal human effort.

Before automation, payrolls were processed manually for the longest time requiring an organization to have a dedicated team to note details essential to their calculations, such as work hours, leave, deductions, and bonuses which was a hectic and time-consuming process. But with automation, businesses can save costs on manual labor and process payrolls in minutes with good payroll software.

So if your business is still using Excel sheets to track attendance and record payroll issues, you should consider investing in payroll software before your organization’s reputation gets dragged on the streets of Nigerian Twitter.

What are the benefits of Payroll Processing Automation?

Aside from protecting your organization’s reputation, payroll processing offers many more benefits than you can imagine. Here are some advantages of adopting an automated payroll processing framework for your organization.

1. Efficiency in payment processing

If you’re used to taking long hours to calculate your employee’s pay after making deductions, there is a way to do it more efficiently. With the automation that guarantees 5x faster payroll processing, you can save time off mundane tasks and focus on more important matters of your organization.

2. Reduced chances for errors

Manual payroll processing is usually prone to errors. For example, 8 out of 10 payrolls processed manually record a mistake, and the last thing you’d want to do to your employee is to delay or make a mistake in their paycheck. But with an automated payroll that helps calculate your employees working hours and make necessary deductions, provided you enter the information required correctly, an improvement in your payroll accuracy is guaranteed.

3. Save costs on hiring

Manual payroll processing requires a lot of work requiring organizations to hire more personnel to handle this task. With automation, you can save costs on hiring a smaller team to get the work done on time.

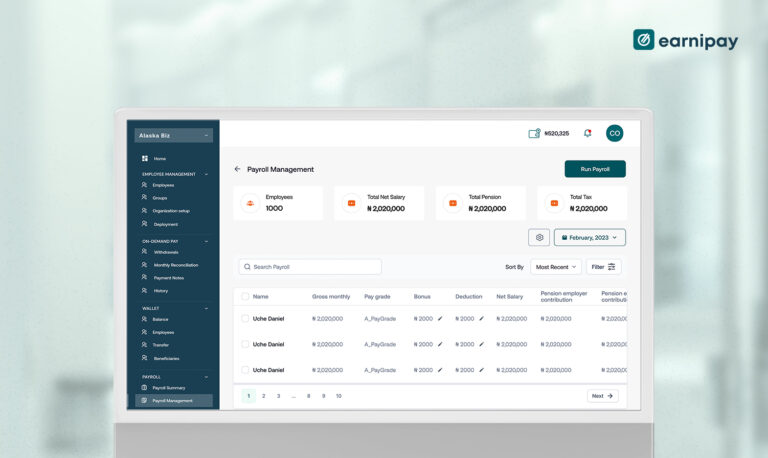

Get on the Payroll Automation Train with Earnipay

Payroll automation is here to stay, and you’d be doing your organization a disservice by not getting on board with payroll processing. Luckily, we at Earnipay are ready to help you transition from manual payroll processing to an automated regime. We especially payroll processing and financing products with startup, medium-sized, and large organizations in mind.

Here’s how our product can help improve your business operation by providing a more efficient payroll processing solution.

- Automate your payroll calculation using your employees’ days worked and pay rate.

- Connect with tax and benefit systems for precise deduction calculation

- Paycheck issuing or direct deposit options for paying employees

- Access to credit to fund your payroll in periods when your organization is financially down

- Advanced security measures to protect your employees’ financial and personal information.

In addition to the immense benefits that our product offers, we offer training and support to guide our users in navigating the platform and its features with ease.

Getting started with our product is easy to get the hang of. Following these steps, you’d have your account up and running;

- Go on to our website and tap the “sign up” button

- Enter the requested contact and business information to create an account.

- Set up your finance and payroll choices. This involves deciding on the frequency of your paycheck, setting up automated payments, and picking the financing choices that best suit your company’s requirements

- Use the product platform to start processing payroll and obtaining funding.

Final Verdict

Payment automation is here to stay. With the number of organizations getting on board with payroll automation, it’s only a matter of time before your organization gets stuck in the past. With the immense benefits automating your payroll processing offers your business, there’s no reason why you shouldn’t consider investing in this product if you can. If you’re ready to join this movement, we at Earnipay have just the right product for you and offer guidance to help you navigate the site and its features. So, why not reach out to us today to get started?

Leave a Comment