Financial wellness in the workplace is becoming an increasingly important topic as many employees are dealing with debt, unexpected expenses, and limited resources, which is, in turn, having a negative impact on their physical and mental health. According to a survey by PwC, over half of the employees say that financial stress is their number one source of stress, which can lead to various issues like absenteeism, poor decision-making, and low productivity.

Take the story of Grace – a product manager at a tech company who, despite earning handsomely, would struggle to pay her monthly bills because of the 28-day wait cycle to get paid. Feeling overwhelmed and stressed out became a problem for her, and it started affecting her productivity, morale, and overall well-being. One day, her line manager observed that she wasn’t concentrating on her work and asked if everything was okay.

Grace opened up to her manager and shared her financial worries. As a top-performing employee, the manager presented the conversation to the HR manager to help with possible solutions. And that’s when the issue of financial wellness came up in the company.

The conventional approach to wellness places emphasis on physical activity. While providing a positive work environment for your employees is essential, you also have a role in promoting their financial wellness.

Ways to promote financial wellness in the workplace.

- Offer Financial Wellness Programs: One of the most effective ways to promote financial wellness is to provide your employees with access to financial education and resources. It could be through seminars, workshops or even one-on-one counselling sessions. By educating employees on the basics of personal finance, they can learn how to manage their money better, reduce their debt and achieve financial stability.

- Promote financial work-life balance: A few ways to promote financial wellness for your employees include flexible schedules, generous paid time off, and the ability to telecommute. By doing this, you are giving your employees an environment that enables your team members to do a good job and still prioritize other important things in their personal lives.

- Provide benefits: Another way you can promote financial wellness as an employer is by providing benefits that support financial stability. Many employers are offering financial wellness benefits in addition to traditional retirement plans due to the pandemic, and that includes flexible spending accounts, health savings accounts, life insurance, and paid time off, but it is important for employers to understand their employees’ needs and references to offer a range of financial benefits that align with those needs.

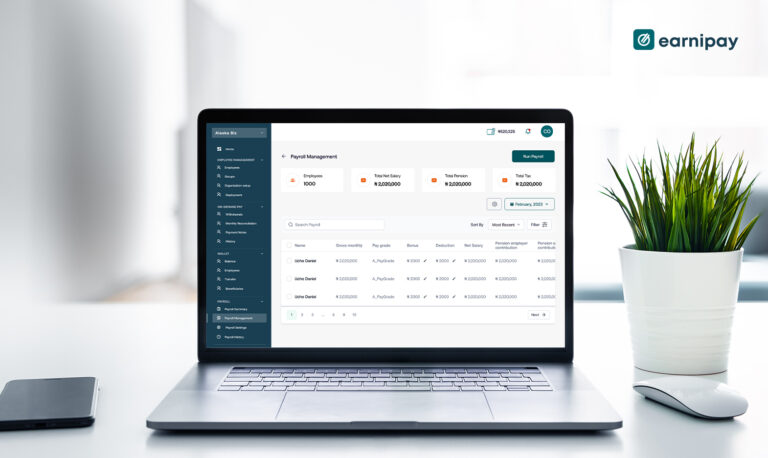

How can EARNIPAY help your employees achieve financial wellness?

In today’s fast-paced world, employees want access to their pay as soon as they’ve earned it, as waiting until the end of the month to receive their salaries can make it difficult for them to manage their finances well, and this is where on-demand pay solution that Earnipay provides can be incredibly helpful.

At Earnipay, we offer an on-demand pay solution that allows employees to access their earned salaries as they work. If you are an employer, this means your employees will be able to access their earned salaries every day at 5 pm. They can access this through our mobile app, web app or USSD (*347*729#) at zero cost to you.

On-demand pay has proven to help employees better manage their finances and reduce their need for predatory loans or other forms of credit. It can also help employees better manage their cash flow and budget their expenses more effectively, as they can easily match their spending with their income and avoid overspending or falling into debt.

Conclusively, by reducing the need for expensive borrowing options, employees can keep their hard-earned money and build their savings over time. As an employer, on-demand pay can help enhance your company’s reputation and help you keep your best talents for a more engaged, productive, and loyal workforce.

Leave a Comment