The influence of technology on business activities in the twenty-first century has helped many businesses grow. Payroll processing is not left out in areas where technology has positively influenced business growth. Many CEOs and HR managers are now looking for ways to improve their payroll process with technology. This article will help guide you in improving your payroll processing using payroll services equipped with advanced technology.

What is Payroll?

Payroll is simply the process of paying the employees in a company the total compensation they get for working with the company. It involves the process from calculating the payment each employee will receive to initiating the compensation payment.

Stages involved in Payroll Processing

Below are the stages to follow in payroll processing:

- Deciding the pay cycle: Every company has a pay cycle for paying its employees. Some may decide it should be bi-weekly or monthly. Most companies use the monthly pay cycle to relieve the company of the stress of payment processing. Determining your pay cycle is the first step to take in payroll processing.

- Collecting employee information, including tax details: The next step in payroll processing is collecting employee banking information and tax details. Having these details will enable the HR manager to be able to determine an employee’s net pay and be able to process their payment.

- Calculating gross payment: The gross payment is the total amount paid to an employee before taxes.

- Determining net payment: After taxes and other deductions are removed from the gross pay, an employee’s remaining payments are referred to as net pay.

- Initiating the payment: There are different ways by which payments are initiated. Some are via manual pay cheques, some by electronic transfer, and some by using third-party payment methods like Earnipay, which offers flexible payments.

- Remitting taxes and keeping payment records: Lastly, as a business owner, you must pay taxes on your employees. These taxes are remitted to the government, and all records are kept for future reference.

How to process payroll

There are various ways to process payroll. Some organisations process their payrolls manually. They use tools like Microsoft Excel to enter the required information for each employee and calculate the amount each employee gets after considering taxes and other minuses from the gross pay. Companies with a few staff usually use this method, though the method is prone to mistakes.

Another method that businesses use in payroll processing is outsourcing. Some companies are solely into the payroll business and charge a particular amount to process payrolls for companies on their client’s lists.

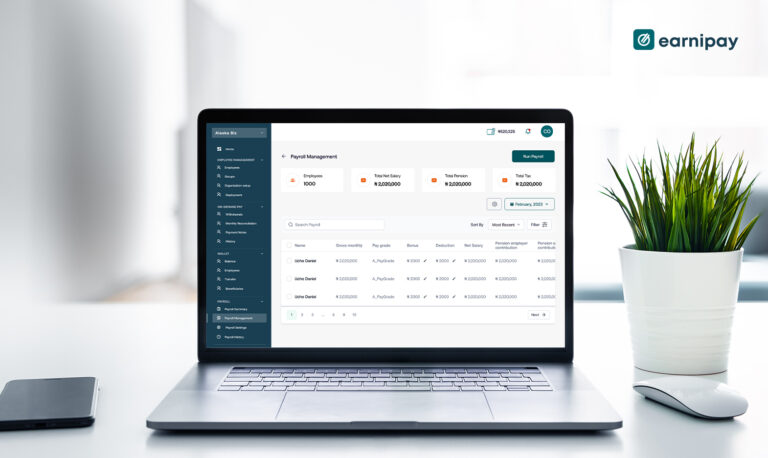

The third method, which is very common nowadays, is online payroll processing solutions. There are online third-party apps that provide payroll processing solutions. All you need to do as a business owner or HR is upload your employees’ payroll details to their database after registering for their service. They will handle the payment of each employee at the scheduled time. You can check out the Earnipay payroll solution to use this service.

How does an online payroll processing service work?

Most online payroll solutions work the same way – They create an interface where employers, HR, or accounting managers can upload the details of each employee on the company’s payroll. They also allow companies to onboard their employees on their platform. This way, if all necessary information is uploaded, including taxes and all relevant deductions, employees’ salaries can automatically be calculated and paid to them at the scheduled times.

Some online payroll solutions also offer flexible payments, known as real-time salary access. Earnipay’s on-demand pay is an example of this flexible payment service. With the on-demand pay solution, employees can withdraw their money anytime they need it. This way, they can easily tend to their immediate needs without seeking payday loans.

Takeaway

The business world is going digital; payroll processing isn’t left off the train. The 2023 payroll trends suggest that most businesses are fast-moving from manual handling methods to using software for their payroll processing. The transition into using software-managed payroll systems is something businesses are fully investing in today. Companies prefer to enjoy the advantages of using such a system, as it is not prone to human errors.

With our Payroll processing solution, you can improve your payroll process and simultaneously have enough time to attend to your business activities for growth.

Leave a Comment